Note Investing vs Origination

This video is VERY IMPORTANT, especially for newer capital investors who are trying to figure out the lending space. Investing your capital in Notes (ie Note Investing) is VASTLY different than creating or originating private loans. At the core, both of these investment methods do allow the private lender to have their money secured to real estate via a security instrument, yet there is a primary difference in when the investor “invest” in the note. When the investor becomes a private lender they are at the very beginning of the lifespan of the loan, when they are a note investor they are purchasing an already existing note.

How to Invest in Private Notes

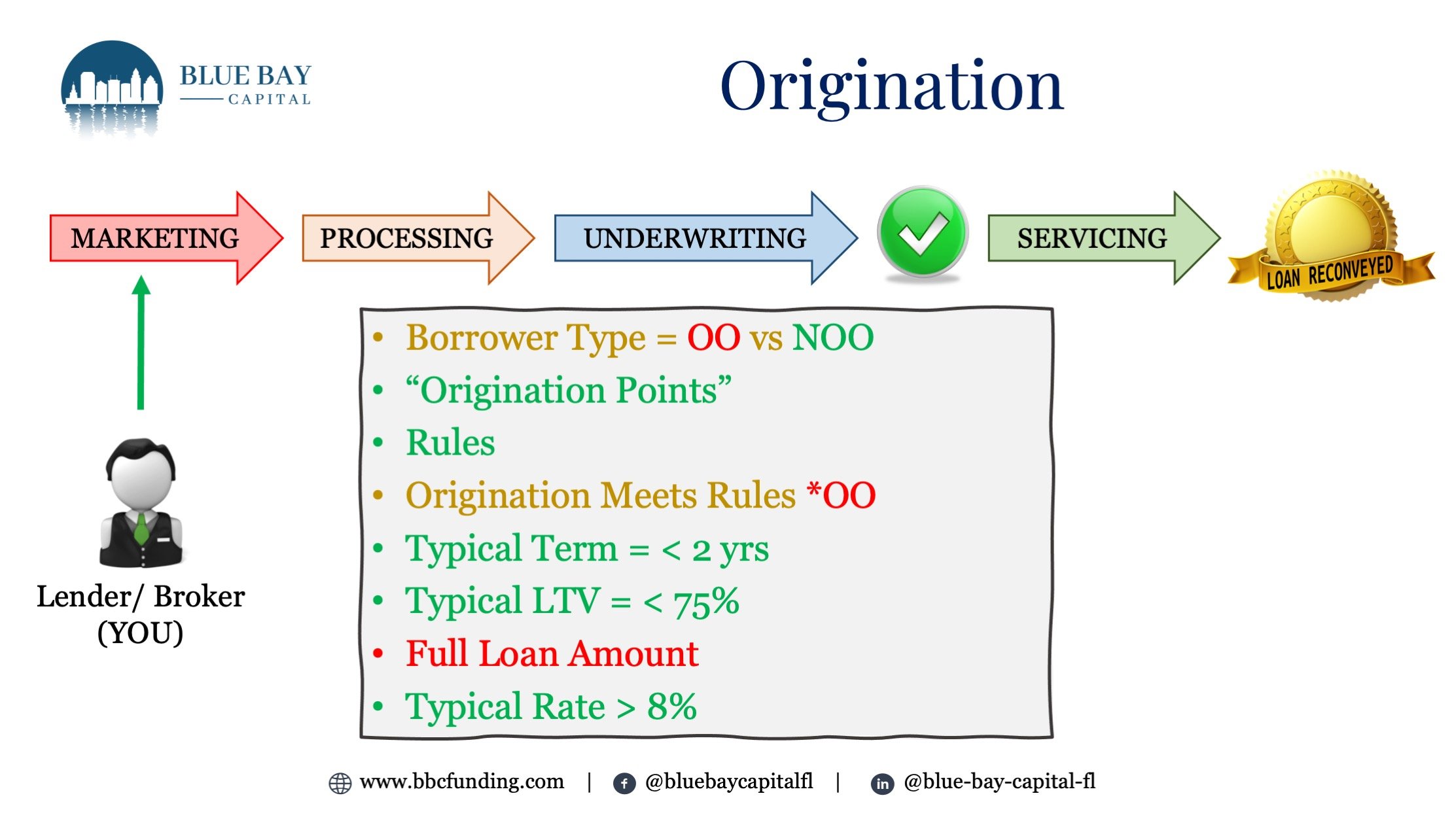

When an investor decides to invest in private notes secured to real estate that has to have the time to market and then process the loan requests. They have to have the time to underwrite each file. Then if the investor decides to fund the loan, and create a note they must have the time, every month to service the loan. Servicing includes more than collecting interest payments. This includes preparing 1099-INT’s, 1098-INT’s, and keeping meticulous accounting of the loan to ensure its performing.

Private Lending Basics

The basics of private lending, what are they? What should a newer private lender be concerned about? What documents should a new private lender collect from a borrower and how does a loan get funded and closed? All of these were basic questions I had when I started my RE Investing journey. in this video, I cover the team players that a Private lender should have on their team, how they look out for your interest and protect your investment, as well what documents you should be collecting from the different key players throughout the process. I dive into an abbreviated timeline from marketing to closing, and how a new private lender and note investor can have an awareness of what’s next.

Where Should I Invest in Private Notes

Whether you have opened a Self Directed Individual Retirement Account “SDIRA” or you have opened a Solo 401K for your business, or you are leveraging a high cash value IUL or even a LOC or HELOC, you will quickly understand that investing in notes can be rewarding. Yet, many of these alternative investment vehicle custodians and salespeople cannot legally teach how to invest much less understand the differences in the note investing space. In this video I want to briefly cover the most under-addressed aspect of note investing and that’s the borrower type.

When Should I Invest in Private Notes

How does the market affect your note investing? This is probably the greatest concern for private lenders. The “market” is often referred to as the housing market, and sometimes referred to as the economy. of course, we can’t look past the government’s influence on the market, so I wanted to discuss how the government can affect when you decide to invest in notes.

Why Should I Invest in Private Notes

Public record is the creme de la creme. Having your Note secured to real property via a security instrument like a mortgage or deed of trust, lets everyone know who loaned the money, how much, who borrowed the money, and what the terms are. The mortgage also stipulates how repayment is supposed to happen, how periodic payments are to be made, and most importantly language that protects you, the lender in the case of default on behalf of the borrower.