Where Should I Invest in Private Notes

Hello investor! Welcome to my real estate investing blog. In this video, I want to speak with capital investors who are looking to make private loans and invest in notes. Note investing has caught a lot of steam in the past few years and more and more people are aware of note investing as a valid and lucrative alternative to traditional investments. Whether you have opened a Self Directed Individual Retirement Account “SDIRA” or you have opened a Solo 401K for your business, or you are leveraging a high cash value IUL or even a LOC or HELOC, you will quickly understand that investing in notes can be rewarding. Yet, many of these alternative investment vehicle custodians and salespeople cannot legally teach how to invest much less understand the differences in the note investing space. In this video, I want to briefly cover the most under-addressed aspect of note investing and that’s the borrower type. Thats right the borrower type will determine A LOT of what you can and cannot do.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

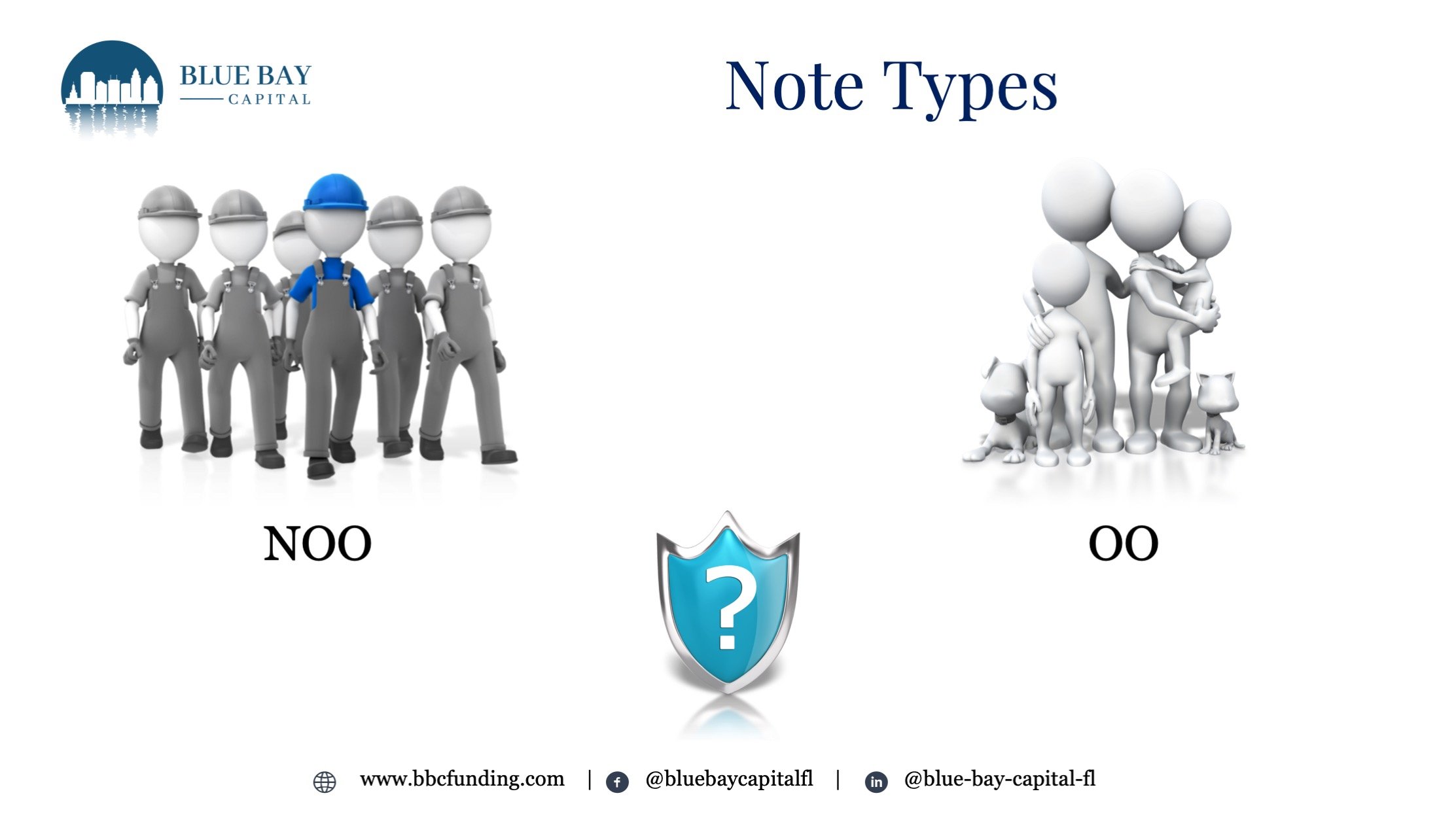

What type of borrower will you lend to?

Many times we think that when investing in the note that the most important aspect of lending is the asset right? The adage goes, if the borrower stops paying you get the property! Yet the TYPE of borrower will determine so much more that you may even be aware of, especially when it comes to the laws of the state the property is in, along with the federal laws.

Know your rights and your borrowers.

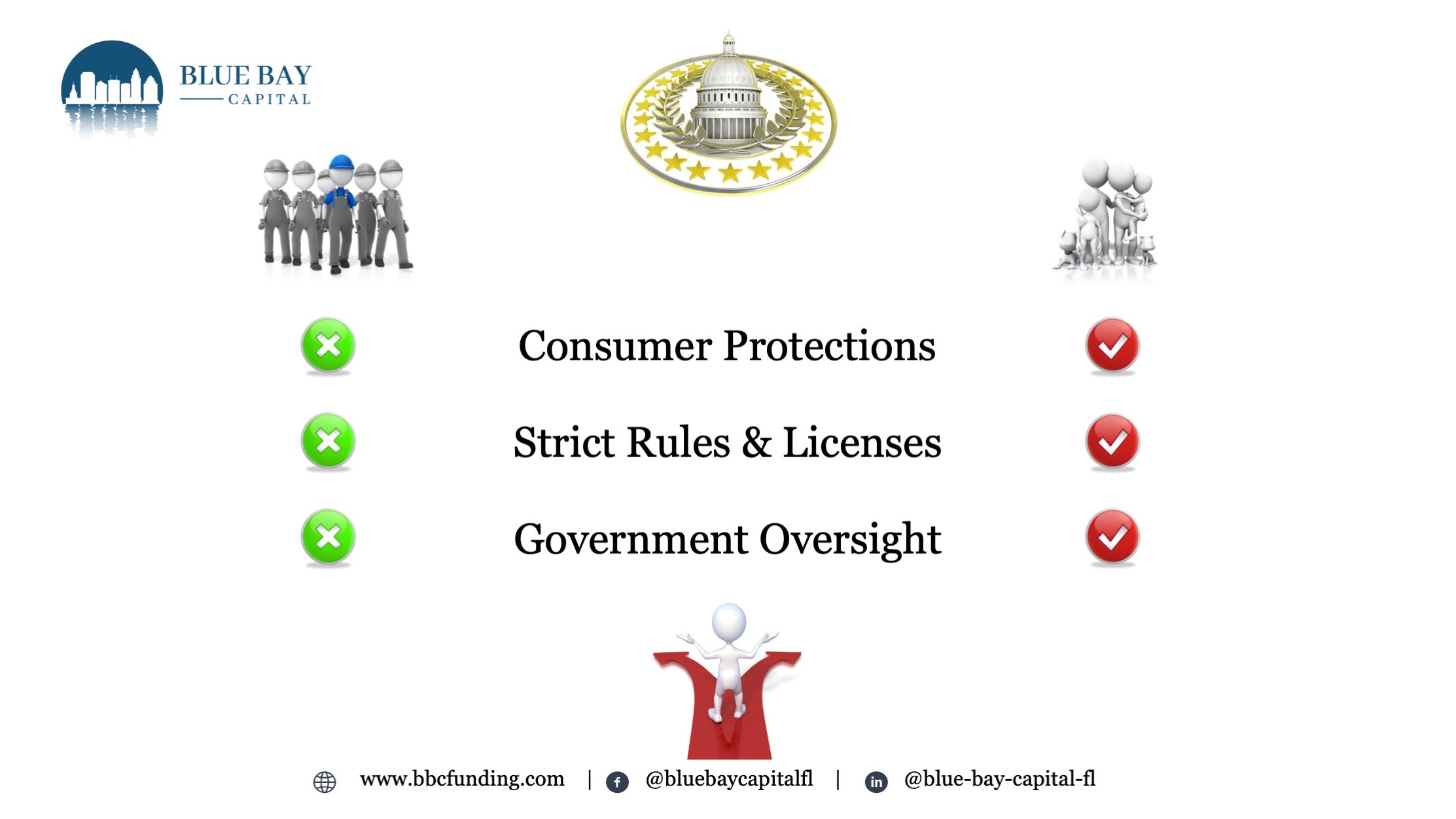

Think of your borrower as either a consumer of your product or a business. Just like in all other areas of law, government oversight and regulation concerning consumer interaction and business interaction is vastly different than when dealing strictly business to business. If you like to have nit-pick, granular oversight from some government entity, that tries to tell you what to do, and how you can do what you want to do, then by all means lend to a borrower who will live in the property. Otherwise, consider lending to an entity where the borrower is a professional investor. The grass is MUCH greener on the side of B2B lending compared to B2C lending.

Location, Location, Location

Many people have asked me, “So where can I lend?” I always respond with how comfortable are you with lending outside your control? I have several capital partners that only want to invest in loans right here in Tampa Bay. I have other investors who are comfortable lending all over the state of Florida, and yet I have others that invest in loans from all over the US. It’s important to know the laws in the state where you plan on investing, and follow the protocol and procedure for investing in those loans.

A note by any other name…

Ahh yes, investing in existing notes or creating new notes. This is the paradox with the industry. By and large when someone says they are a “Note Investor” they typically buy existing notes, performing or non-performing at a discount. The greatest disadvantage to this type of note investing is that 99% of the time note holders who are advertising a note for sale have loaned to an owner-occupied, ie a consumer. It is my true belief that as a note investor you should drive to create or “originate” your own loans. This way you have control. i will go over the differences below.

New versus used notes, your choice

This part of investing can be very fractalized. These are general rules of thumb, but there are always exceptions. Remember, private lending, also called note investing, should be about one thing and one thing only, mitigating risks, meaning reducing your risks, and then shifting all risks to the borrower. At the end of the day when you invest in a note that is secured to someone’s dwelling, primary or secondary, you as the note creator/ originator immediately fall under the oversight of several government regulating bodies. I always recommend that note investors stay on the safe side of investing, which is short-term, 24 months or less, interest-only loans. Investing outside these parameters can open you up to a world of hurt.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do by lending your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution. You can learn more about my Turn-Key solution by clicking on the bottom below.