Note Investing vs Origination

Hello investors and good day. This video is VERY IMPORTANT, especially for newer capital investors who are trying to figure out the lending space. Investing your capital in Notes (ie Note Investing) is VASTLY different than creating or originating private loans. At the core, both of these investment methods do allow the private lender to have their money secured to real estate via a security instrument, yet there is a primary difference in when the investor “invest” in the note. When the investor becomes a private lender they are at the very beginning of the lifespan of the loan, when they are a note investor they are purchasing an already existing note. In the video, I describe the reason why this difference so is big, as well as the type of loans a private lender is investing in depending on which method of note investing they are using.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

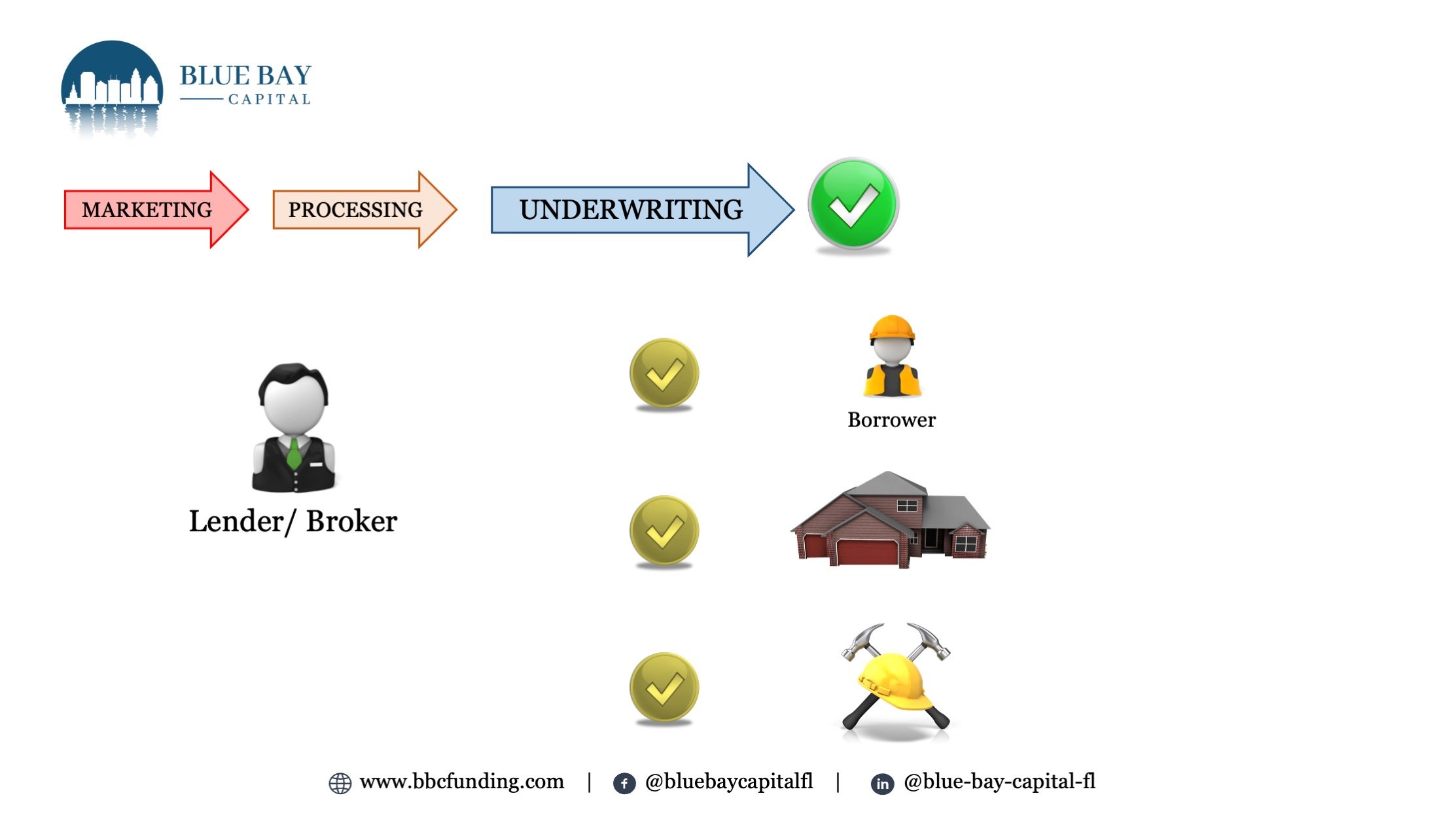

Marketing for your investment borrowers

Marketing simply means how a lender finds potential loans. In other videos, I cover different ways a lender may identify and find borrowers, but in this scenario we will say the lender is a direct marketer, meaning they are “directly” responsible for finding potential loans. This may include attending RE Meetings, networking events, social media, and even conferences or trade shows. As a lender, you will come across many tire kickers, bad loans, and borrowers that don’t meet your qualifications. Rest assured you WILL go through MANY loan requests to find loans that fit your ‘box”. Eventually, you will find a solid borrower, with the right property, and the right project. This request from the borrower will turn into a loan application.

What does Processing a loan mean?

At a high-level processing is all about gathering documents and vetting the basic information, knowing how to vet that information, and knowing what documents to request from which parties. Borrower documents, property documents, project documents, title documents, and insurance documents are the main types of documents a private lender should collect during processing. Knowing what those documents look like, and what information should be found in these documents is critical to a private lender knowing how to vet a borrower, property, and project.

What does underwriting mean?

Underwriting is normally the least complicated process, but it is the most critical. Once you know what documents you are supposed to be looking at underwriting is simply a verification and validation of those documents. You have the borrower’s documents, now does everything line up? Is the borrower who they say they are, do they have the experience they say they have? The property the borrower is putting up for collateral, does it exist? Do the property values hold up? Does the project make sense, is it feasible and is the borrower’s team (the contractors) capable? Once these questions among a myriad of additional questions are answered to your satisfaction, you are ready to close.

Getting paid back

We now come to the end of the loan and the borrower makes their final principal and interest payment or they pay off the loan in full if it’s a balloon payment. This is called a “Reconveyance”, where the lender’s remaining principal is given back to the lender. This can happen primarily in two ways assuming the loan has performed the entire length or term of the loan. #1 through the sale of the property, #2 the borrower refinances the loan amount with a different lender. In any case, the lender receives all remaining principal back along with all unpaid interest, fees, and penalties.

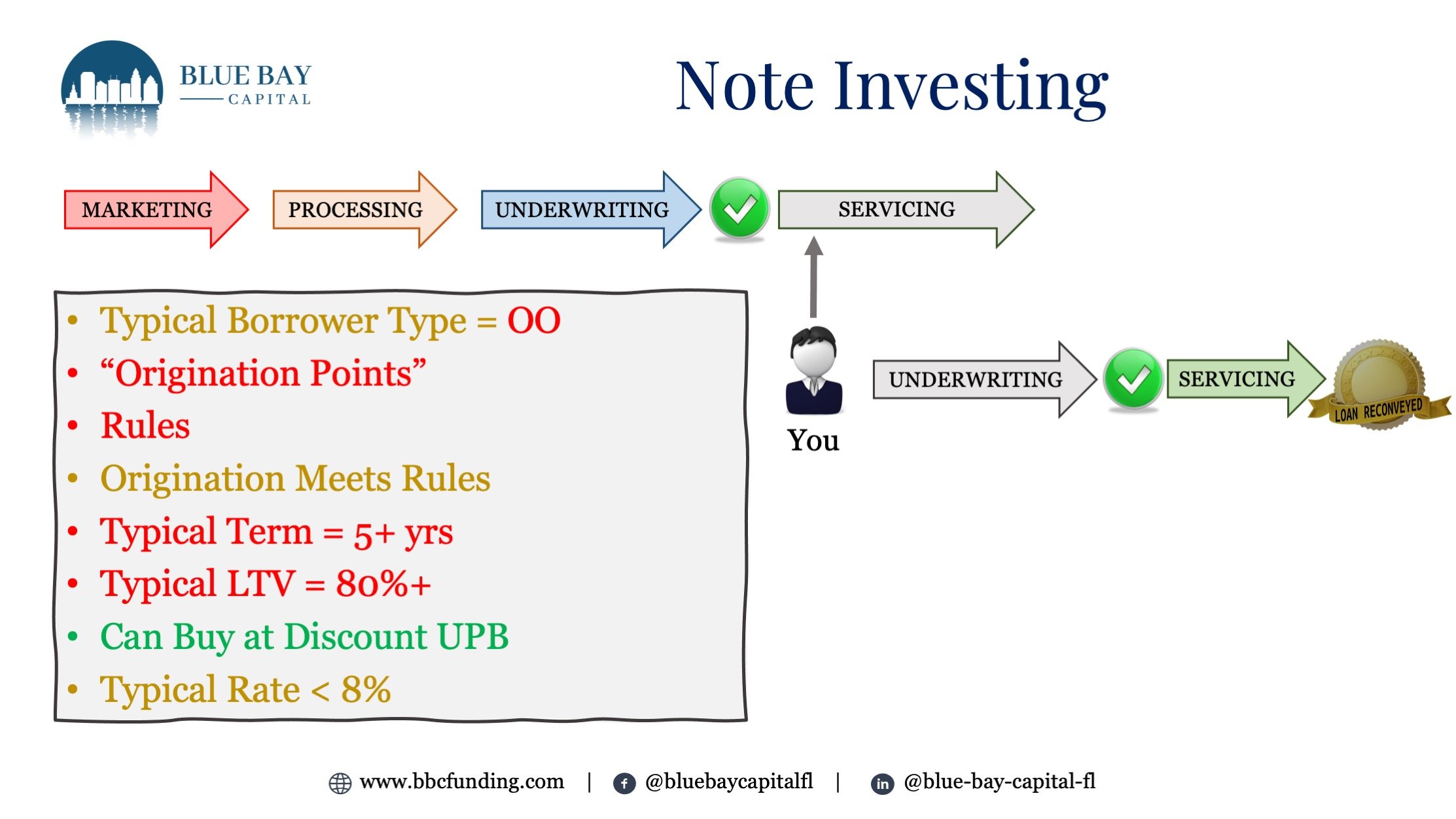

Note Investing Pros and Cons

As you can see to the left, there are several cons and pros to being a note investor. In the video, I describe what exactly makes you a note investor instead of a private lender. The primary difference is the borrower type. Namely in almost all cases when a note investor is seeking for notes to invest in they are going to find OO loans. This presents quite the issue in several states, as being a not investor (ie lender) on a loan to a person’s primary or secondary residences, requires licensure as well specific documents and disclosures based on Federal and State law. My recommendation… do not invest in OO notes.

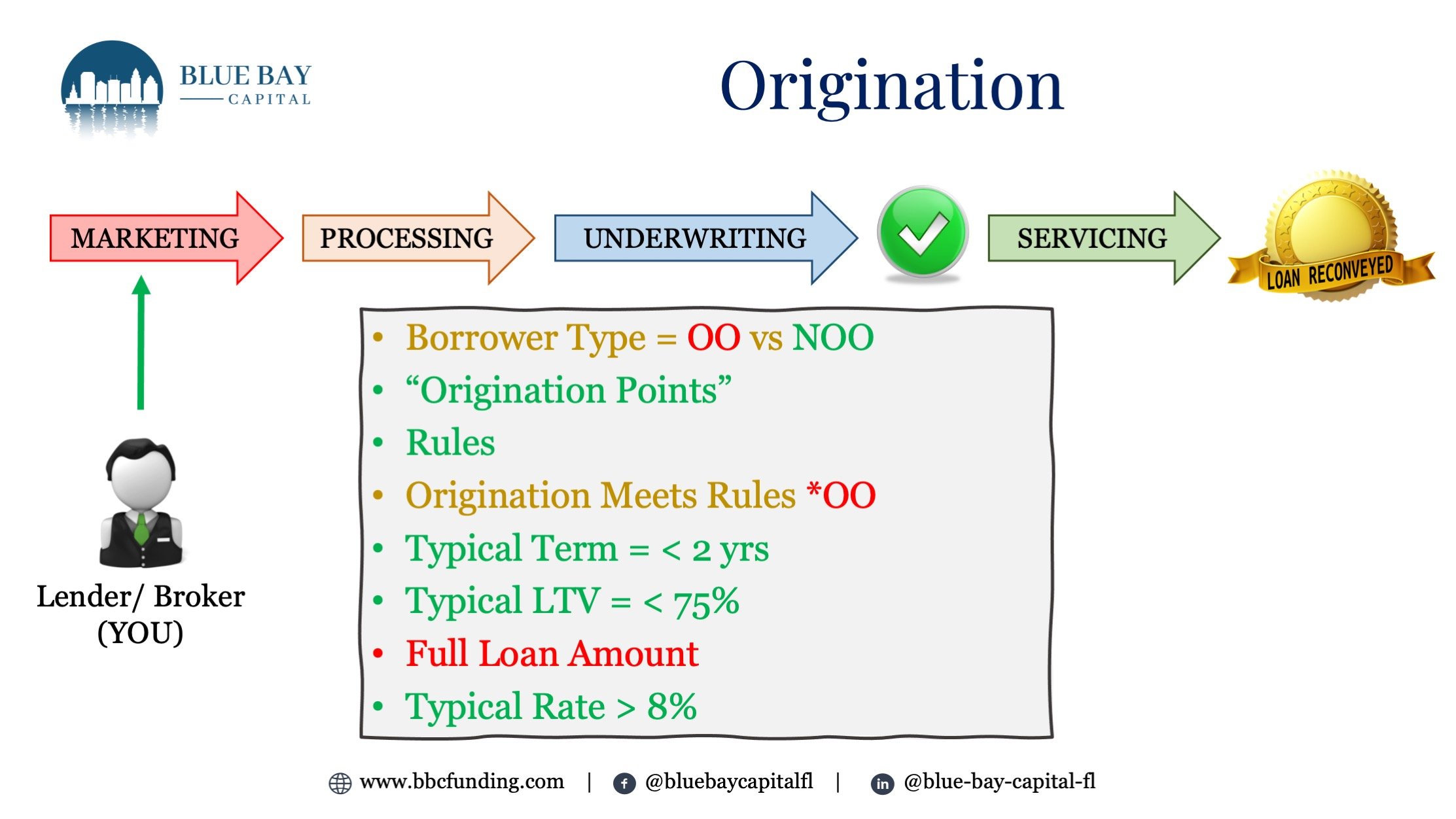

Private Lending Pros and Cons

When a private lender invest from the origination or creation of a note they are at the very beginning, and they make the rules. This is so critical. Also, you can determine who your borrowers are and as I discussed earlier ensuring you are lending to NOO borrowers (real estate investors) completely puts you outside the oversight and regulatory oversight by federal and state governments. The grass is greener on this side of the lending fence, and I teach people how to play on this side. If you are ever interested in attending my complete academy-level course on private lending, shoot me an email and request to be put on my launch email lists for our next class date.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do, and lend your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution.