Private Lending Basics

The basics of private lending, what are they? What should a newer private lender be concerned about? What documents should a new private lender collect from a borrower and how does a loan get funded and closed? All of these were basic questions I had when I started my RE Investing journey. In this video, I cover the team players that a private lender should have on their team, how they look out for your interest and protect your investment, as well what documents you should be collecting from the different key players throughout the process. I dive into an abbreviated timeline from marketing to closing, and how a new private lender and note investor can have an awareness of what’s next. If you are interested in a complete academy-level course covering a-z of private lending, email me at the bottom of the blog post and ask to be put on my Private Lending 101-course notification email list.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

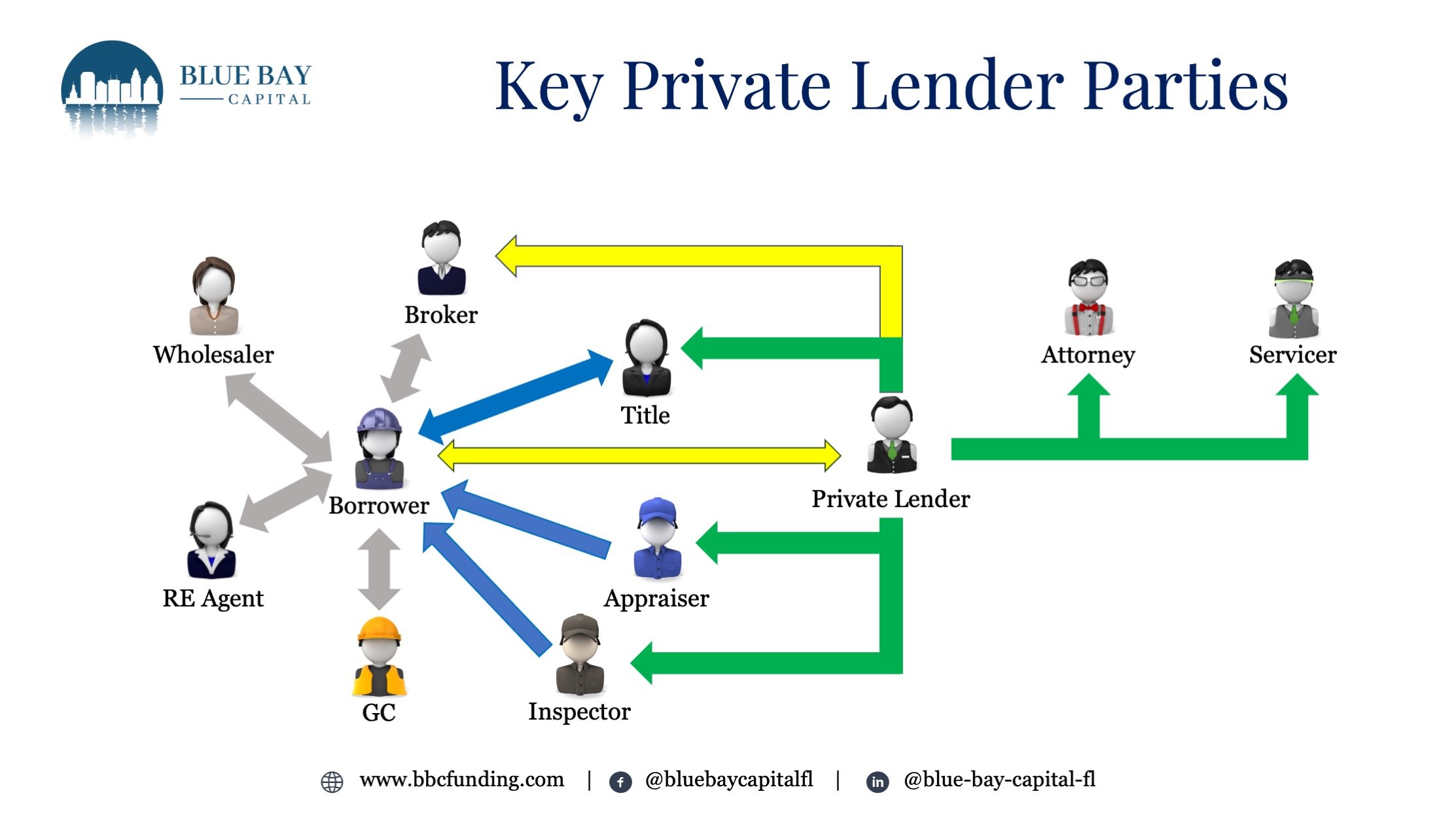

Key Players in a Private Loan

I discuss how the different players throughout the lifespan of a loan work for you as the private lender and which ones work for the borrower. Hint, Its ABSOLUTELY imperative that the key players that work for you, and protect your interest are players that you have identified and that you hire. NEVER use the borrower’s recommendation for your key players. In the video I also discuss what documents each of these key players should be providing you as the lender.

Marketing for investment property borrowers

Saying “Hello” to potential borrowers is critical to growing a private lending business. There are two primary places to find borrowers, directly or through a network. Directly finding borrowers can consume time, energy and resources. You must attend networking events, online and in person, attend conferences and trade shows, and attend seminars. The other option is to plug into existing networks. The best source of existing networks would be brokers, as well-established RE Agents, and even title companies.

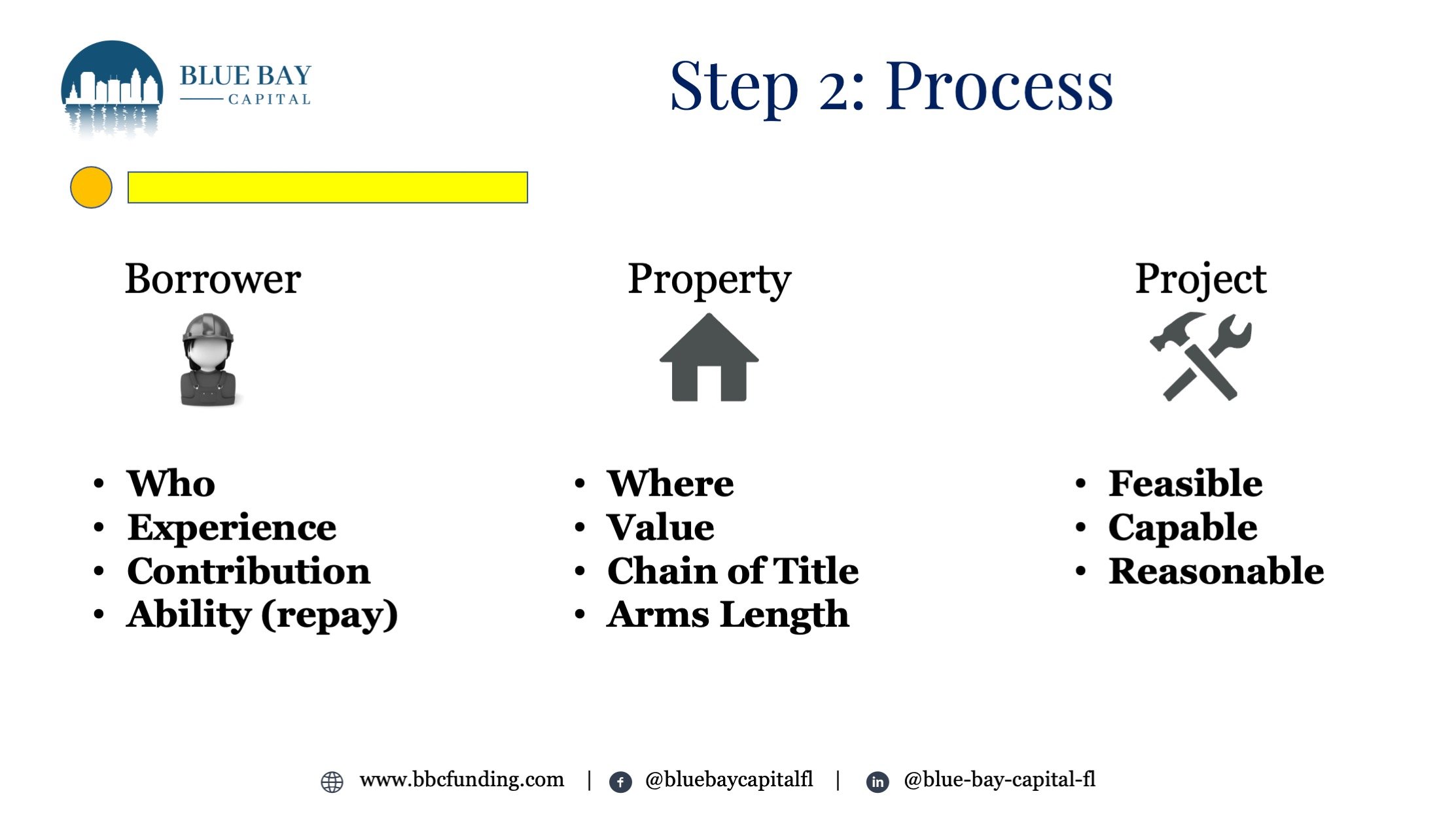

Processing an investment loan

As you enter the processing of a loan, once a valid loan request has been submitted, you should focus on “processing” the loan request. Processing simply means gathering documents and following up with the client. There should be three categories you should focus on, Borrower, Property and Project. Obviously, the project category is only important if your borrower is renovating or building a new property. These are general questions that you should be able to answer during your processing and this leads to your underwriting as well. In the video, I also cover extremely important documents that you should require from your borrower. So be sure to watch to get that full list.

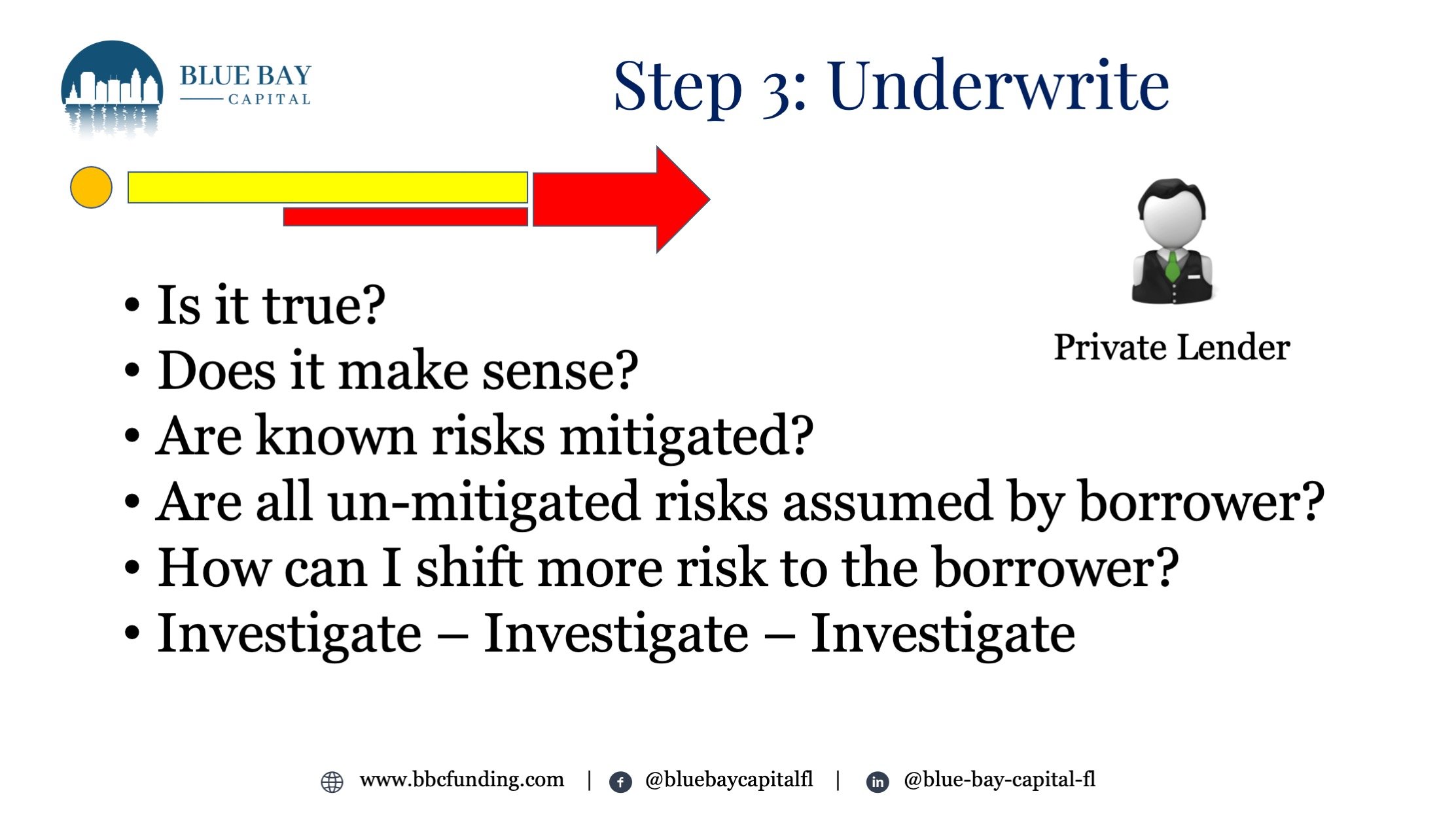

Underwriting an investment loan

What is underwriting and how do you do this as a new private lender? In the video, I discuss the primary questions you should be asking and what the intended result from each of these questions is. At the end of the day, the goal of underwriting is to try and find a reason NOT to do the loan, then can that reason be mitigated? If not it is highly advisable not to make the loan.

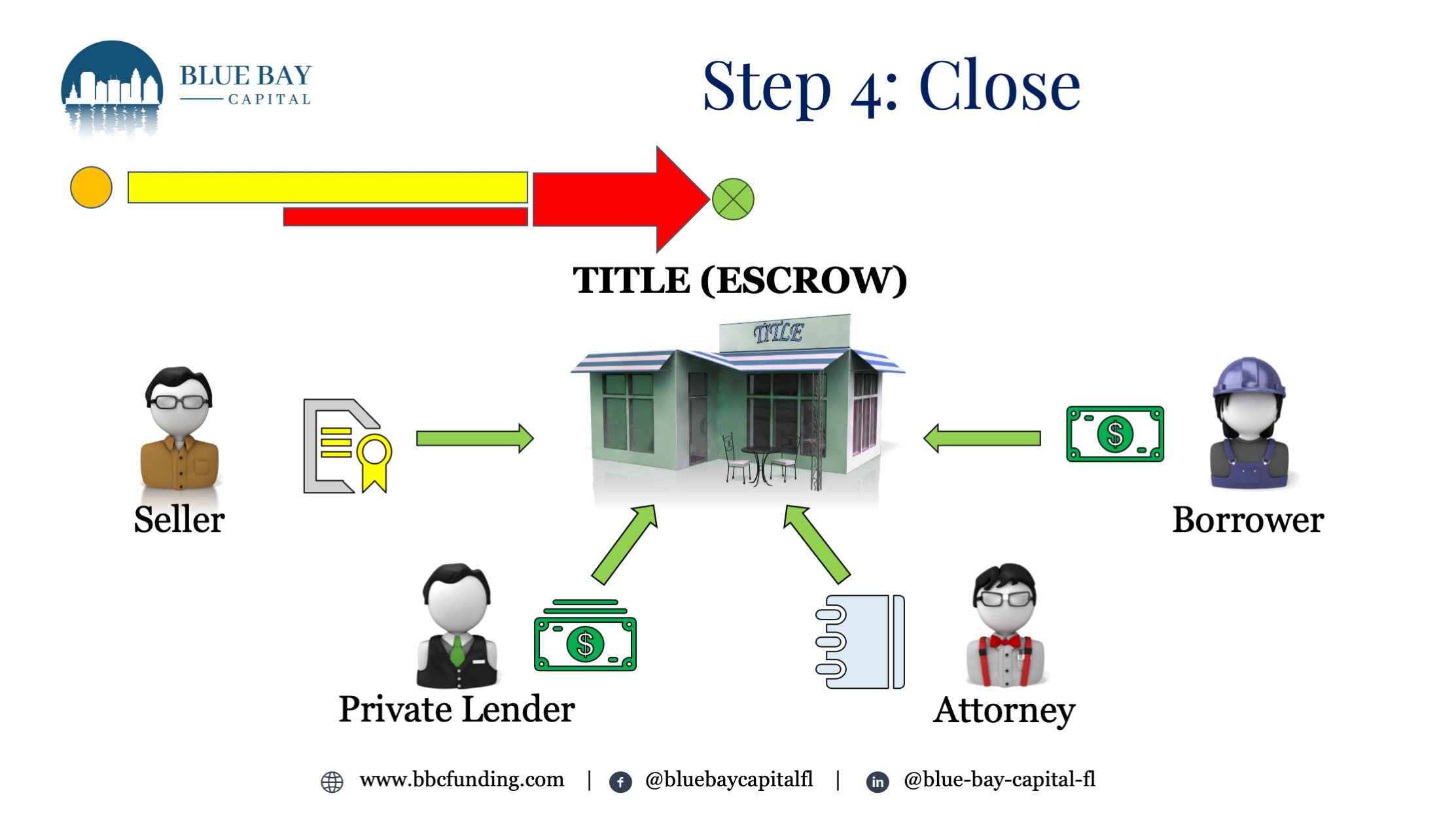

What happens during closing

While closing may seem like the biggest challenge it is not for the lender. It’s actually the easiest step of making a loan. At this point, all you are doing is wiring in funds and making sure that all your loan documents have been properly executed. It is HIGHLY advised that you have a title company or even your own attorney handle the function of escrow. This way there is a check and balance to ensure all requirements for the loan being made are done correctly. What you DO NOT want have happen is the borrower receiving your money without properly executing the loan docs or not having your security instruments recorded in the county in which the property is located.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do, and lend your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution.