How to Invest in Private Notes

In the video above I discuss the main ways that investors are able to invest in private notes, secured to real estate. I cover the three key KPI’s to be successful; Time, Knowledge, and Experience. I also detail the four stages of note investing, and what is required from each of these KPI’s depending on which method you choose to invest in notes. I will do a deep dive in why these three KPI’s are important for each one of the stages within the note investing world, and ultimately how I believe Blue Bay Capital can solve the problems, headaches and issues that arise when trying to invest through one of the previously mentioned ways.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

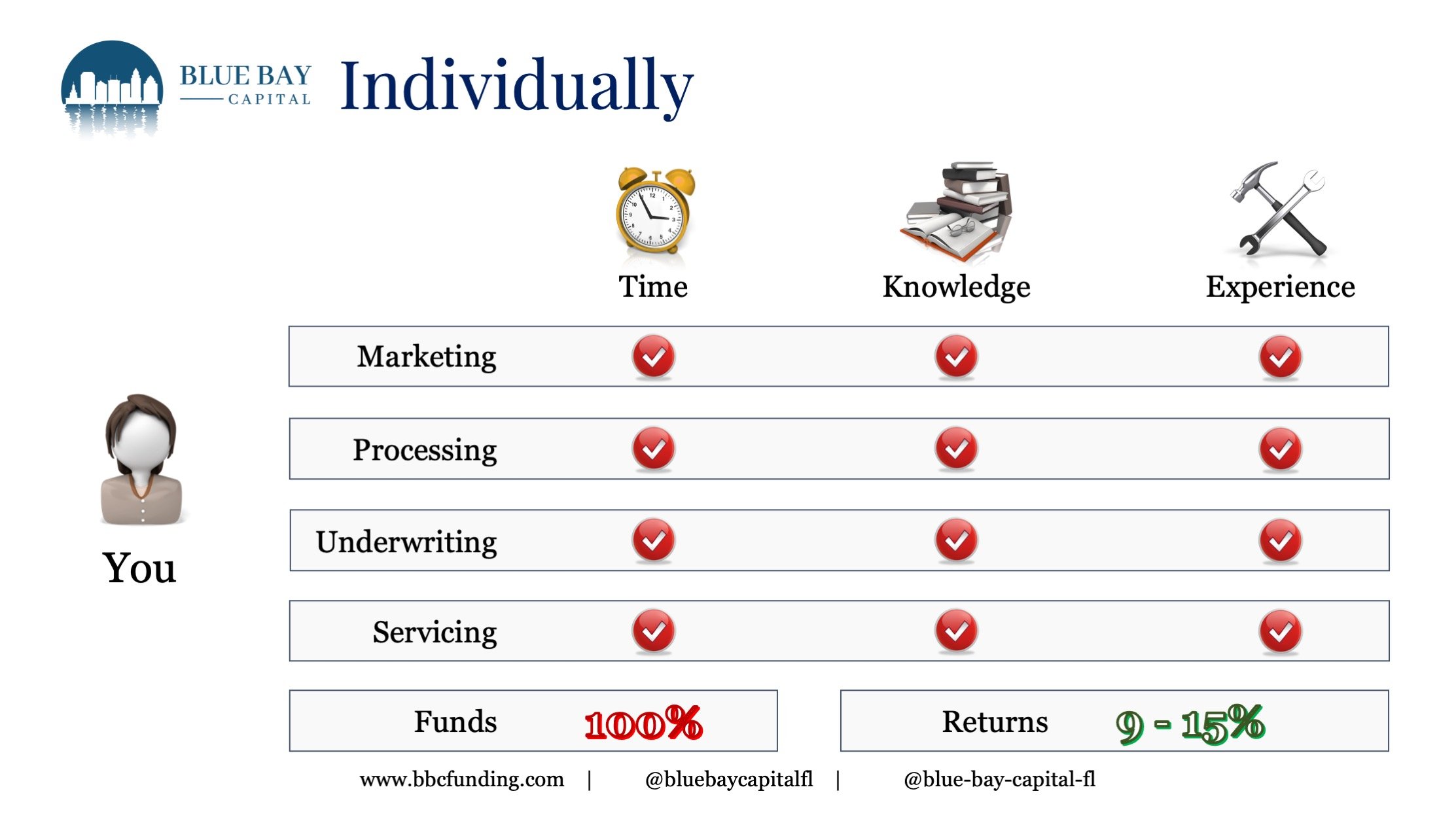

Individually Investing in Notes

When an investor decides to invest in private notes secured to real estate that has to have the time to market and then process the loan requests. They have to have the time to underwrite each file. Then if the investor decides to fund the loan, and create a note they must have the time, every month to service the loan. Servicing includes more than collecting interest payments. This includes preparing 1099-INT’s, 1098-INT’s, and keeping meticulous accounting of the loan to ensure its performing. They must also have the knowledge and experience for each one of these stages of note investing to be successful. This can quickly turn into a full-time job, which causes many new note investors to shy away.

Investing in Notes Through a Broker

While investing through a broker may seem like a great solution to time commitments, it’s not always what it seems. Sure the broker will market for the deal, and process the loan request, but at the end of the day, a broker has none of their own capital to risk. They will push you to fund the loan/ buy the note because, at the end of the day, they are focused on one thing, closing the loan and getting paid. If the loan does not close they don’t get paid, and they can become quite ornery. As well, and I have seen this, the broker is NOT looking out for your interest either. If they bring a borrower, or property or project to you for funding, and you fund that loan request, after it closes, the broker is no longer involved, and they are legally protected if the loan goes bad.

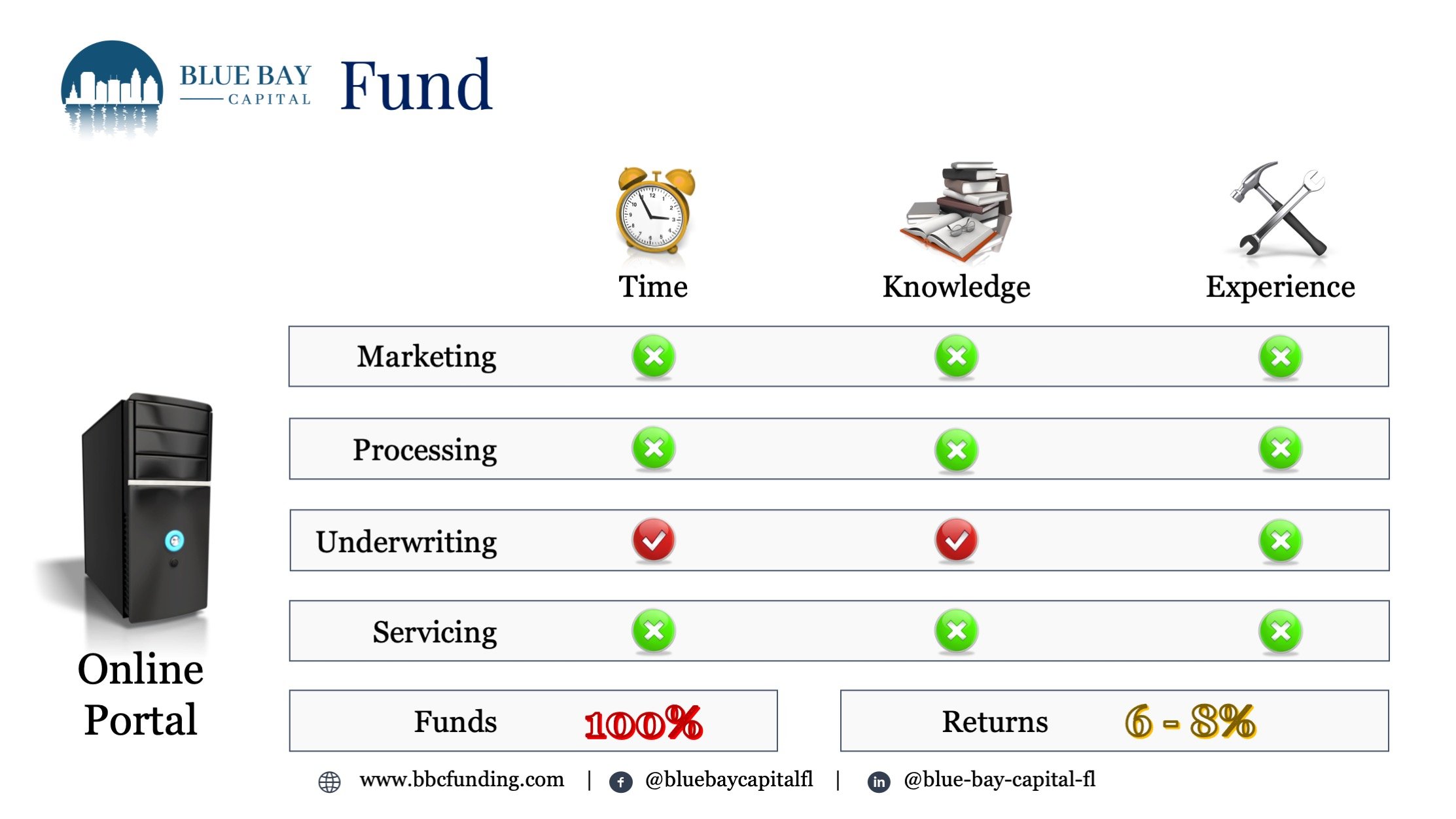

Investing in Notes Online

Investing in notes online can be a great solution, however your are at the behest and mercy of the platform. Some platforms you may not even be able to ask the originator (sometimes a broker/ sometimes the note seller) how the note was processed and underwritten. More so you are dealing with large national companies. The likelihood that you will have a direct line to the owner of the company is rare if ever. In any case, you still must possess the knowledge and the time to be able to underwrite the loan before you invest, otherwise you could be making a bad investment.

Investing in Notes Through Blue Bay Capital

We specialize in providing turn-key private lending solutions. We literally handle everything for our note investors from A-to-Z. More important you have a direct line to me, Edwin Epperson, owner and manager of Blue Bay Capital. All our loans are short-term, interest only and are focused on making loans to professional real estate investors who have a proven track record. Since 2014 when I started this business I have only had 4 loans go into default. This is out of 100+. My track record speaks for itself. Also, the BIGGEST benefit for my capital investors is they are able to participate in the loan amount, they do NOT have to fully fund the loan. There are several blogs that address how and why this is done, and I welcome your questions and interest!

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do, and lend your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution.