Why Should I Invest in Private Notes

Hello investor, and welcome to my blog! WHY people do what they do has always been a focus of study and psychology. Why you should consider investing in notes, secured to real estate is a question I hope to answer in this video. I will discuss private note investing, and why investors who are seeking alternative investment strategies, outside of the stock market, and even diversifying outside of rental assets could be a viable and lucrative investment strategy for you. You do NOT want to miss this incredible video and the brief blog below! At the end of the blog I have a FREE eBook for you to download. The eBook, “Deception of Passive Income” examines the three most common investment vehicles for generating passive income, yet it is not what it seems. I look forward to hearing back from you and discussing our turn-key private lending solution in detail!

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

Security of your note investing

Why invest in private notes? Security thats why! When you invest in a note secured to real property, you take significant risk mitigation steps. Your investment cannot “vanish”. Understanding WHAT secures your capital though is critically important, it is paramount. Otherwise, you may think that you are “secured” simply because your borrower tells you that your money will be used for a project and because they signed a “note” to you promising to pay, yet in reality, you could actually have an unsecured note. Education is critical and this is what I strive for.

The laws protects you, like a bank

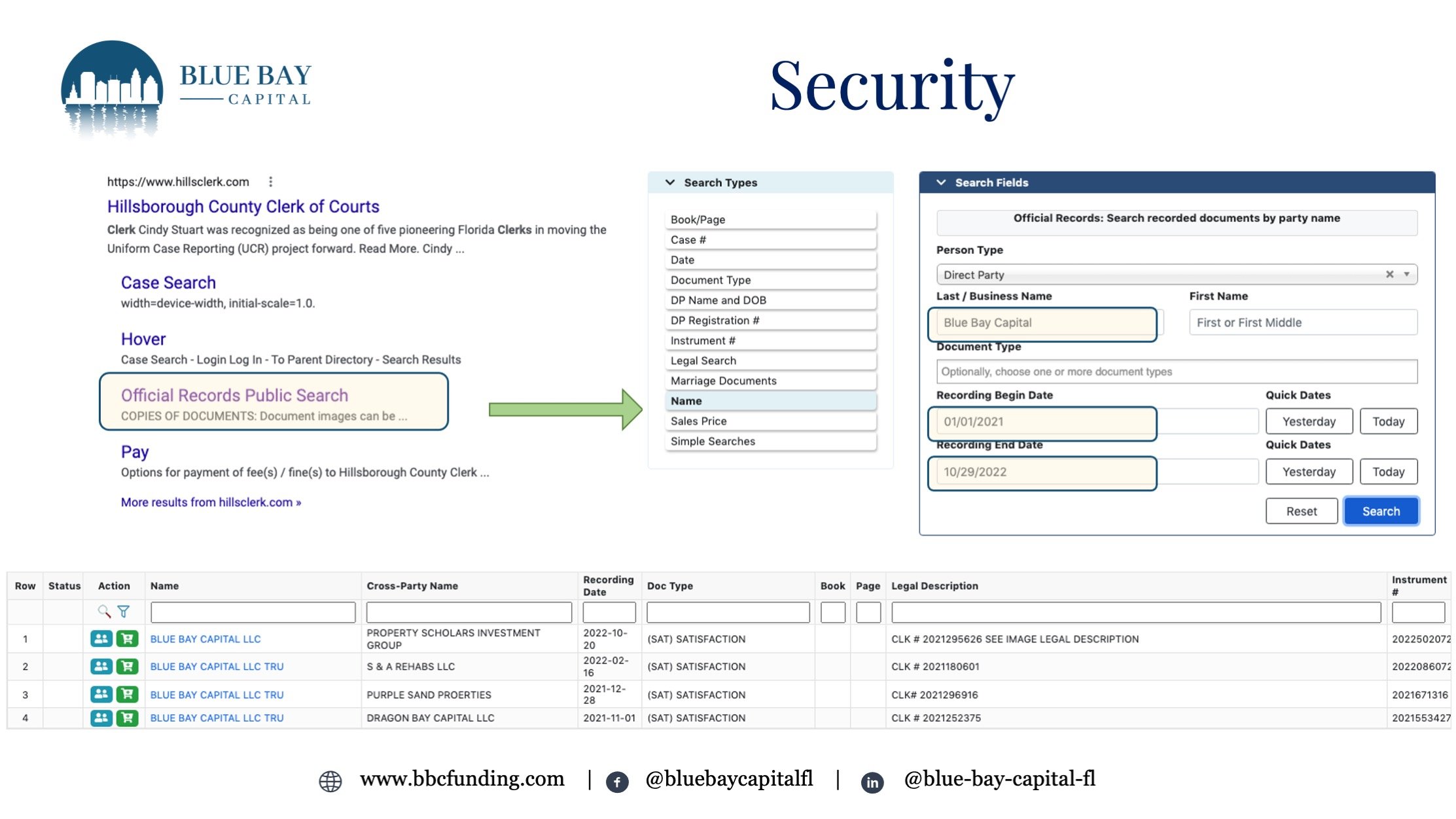

When you play on the side of the table that the big banks play, you play a game where the laws and the courts are predisposed to act and rule in your favor. This is why investing in notes secured to real estate is so powerful! The goal ultimately is security, NOT high returns. What’s even more powerful, when done correctly your secured private note is viewable on public record. It is the ultimate form of transparency. Here’s how you can look to see what loans Blue Bay Capital and my partner investors made in Hillsborough county FL.

Public record is the crème de la crème

Having your Note secured to real property via a security instrument like a mortgage or deed of trust, lets everyone know who loaned the money, how much, who borrowed the money, and what the terms are. The mortgage also stipulates how repayment is supposed to happen, how periodic payments are to be made, and most importantly language that protects you, the lender in the case of default on behalf of the borrower.

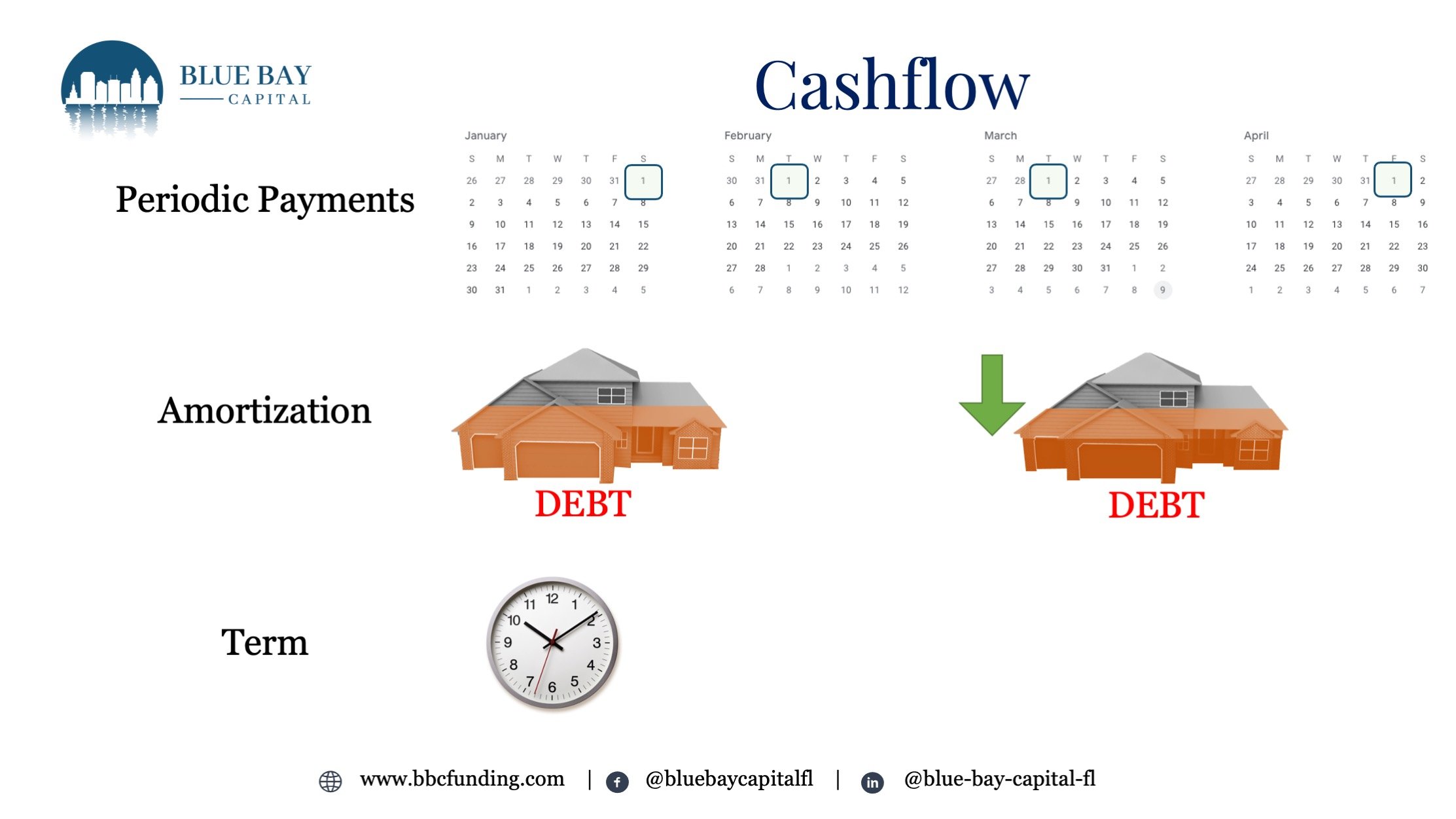

If cash is king, cashflow is the throne

Why invest in private notes from origination? You get to make the rules! Thats right when you are party to the creation of the note you are able to determine how long the loan will be for, how often they make payments, if it is interest only or fully amortized, and if its a balloon note. The power of being a part of the note creation is extremely empowering and puts the control of your investments back in your hands. You have more control, no… ULTIMATE control over building, protecting, and preserving your family’s generational wealth!

If you loose control, you loose everything

When you are NOT involved in the not creation, also called origination, you give up control. Another lender takes that control from you. You must be skilled and versed in mortgage language, and you will have to trust that prior lender originated the notes according to federal and state laws. Or you will have to hire an attorney to review and critique each note you’re considering buying to ensure the prior lender met the law. This can be expensive and cost-prohibitive. This is why you should be involved from the very beginning.

Dividend stocks versus notes

How does note investing differ from say… dividend-paying stock? Let’s take a look at a dividend-paying stock, that many people would say is a “blue chip” company, Apple. If you could invest in Apple stock, but through the lense of a lender, how different it looks! I mean, who would NOT invest in stocks if you could do this!? Unfortunately, this method does not exist, and in short, if you wish to have the security, dependability, and assurances of note investing, invest in notes secured to real estate!

FREE EBOOK! Download it below to discover a side-by-side comparison of investing in dividend-paying stock, real estate rentals, and private loans.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do by lending your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution. You can learn more about my Turn-Key solution by clicking on the bottom below.