Are Notes Better Than Rentals?

During the next couple of slides, I will go over how this saying is true, and depending on which side you play on, you will benefit from. In this first slide, we have a lender with $150K and a borrower with $150K. The borrower wants to use leverage, ie the lender’s capital to help him buy this property. The As-Is value is $210K, so the borrower does not have enough, but he does have 30% to put down towards the loan. The lender is willing to give a $147K loan @8% annually, amortized over 15 yrs. The PI payment is $1,405 per month, the borrower will have to pay for taxes and insurance themself. The borrower has to put down $63K but still has $87K remaining.

GAP Funding

The term GAP Funding is often associated with high returns, quick turnaround, and fast profits for the lender. The issue is that most new lenders are not aware of what exactly GAP Funding is, and if they are speaking with their borrowers to educate them, then they are allowing the fox into the hen house and taking the fox’s advice on how to secure the hen house against… foxes. In this video I advocate against newer private lenders participating in this type of loan, as well I offer some measures that they can take to shore up their risk and shift more of it to the borrower.

Note Investing vs Origination

This video is VERY IMPORTANT, especially for newer capital investors who are trying to figure out the lending space. Investing your capital in Notes (ie Note Investing) is VASTLY different than creating or originating private loans. At the core, both of these investment methods do allow the private lender to have their money secured to real estate via a security instrument, yet there is a primary difference in when the investor “invest” in the note. When the investor becomes a private lender they are at the very beginning of the lifespan of the loan, when they are a note investor they are purchasing an already existing note.

Private Lending Basics

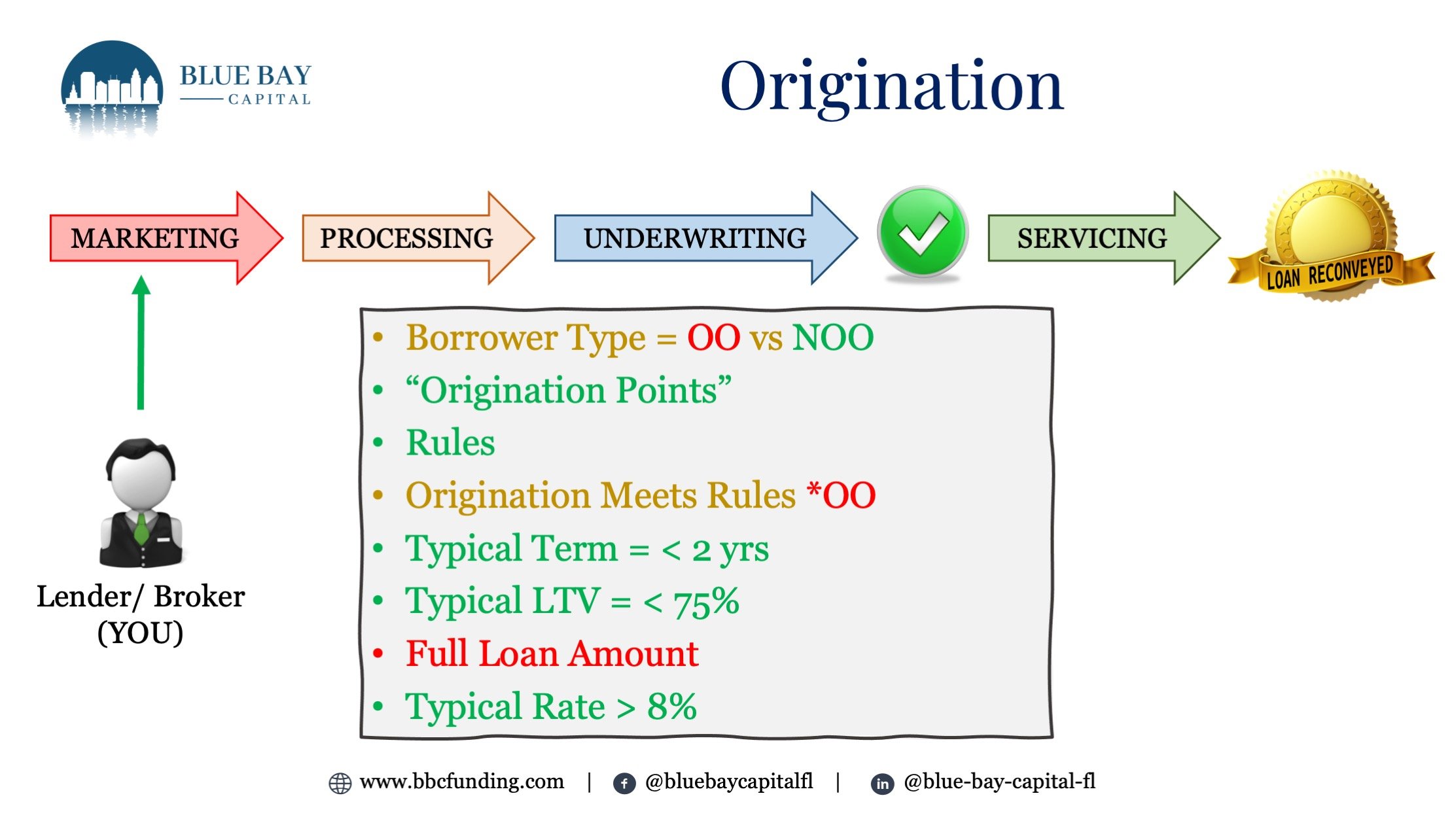

The basics of private lending, what are they? What should a newer private lender be concerned about? What documents should a new private lender collect from a borrower and how does a loan get funded and closed? All of these were basic questions I had when I started my RE Investing journey. in this video, I cover the team players that a Private lender should have on their team, how they look out for your interest and protect your investment, as well what documents you should be collecting from the different key players throughout the process. I dive into an abbreviated timeline from marketing to closing, and how a new private lender and note investor can have an awareness of what’s next.

Where Should I Invest in Private Notes

Whether you have opened a Self Directed Individual Retirement Account “SDIRA” or you have opened a Solo 401K for your business, or you are leveraging a high cash value IUL or even a LOC or HELOC, you will quickly understand that investing in notes can be rewarding. Yet, many of these alternative investment vehicle custodians and salespeople cannot legally teach how to invest much less understand the differences in the note investing space. In this video I want to briefly cover the most under-addressed aspect of note investing and that’s the borrower type.

When Should I Invest in Private Notes

How does the market affect your note investing? This is probably the greatest concern for private lenders. The “market” is often referred to as the housing market, and sometimes referred to as the economy. of course, we can’t look past the government’s influence on the market, so I wanted to discuss how the government can affect when you decide to invest in notes.