Are Notes Better Than Rentals?

Hello investor and good day. I wanted to share with you a conversation I have had with many rental investors, and even those that are looking at investing in rentals. There are some big differences between the two, and it really boils down to Time, Knowledge and Experience. If you don’t have those three capabilities right now, then finding a company that will help you overcome these challenges is critical to your success. Blue Bay Capital offers a solution for investors seeking the ability to invest in notes but from a completely passive standpoint. Watch my video above as I discuss the key differences between note investing and rental property investing.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

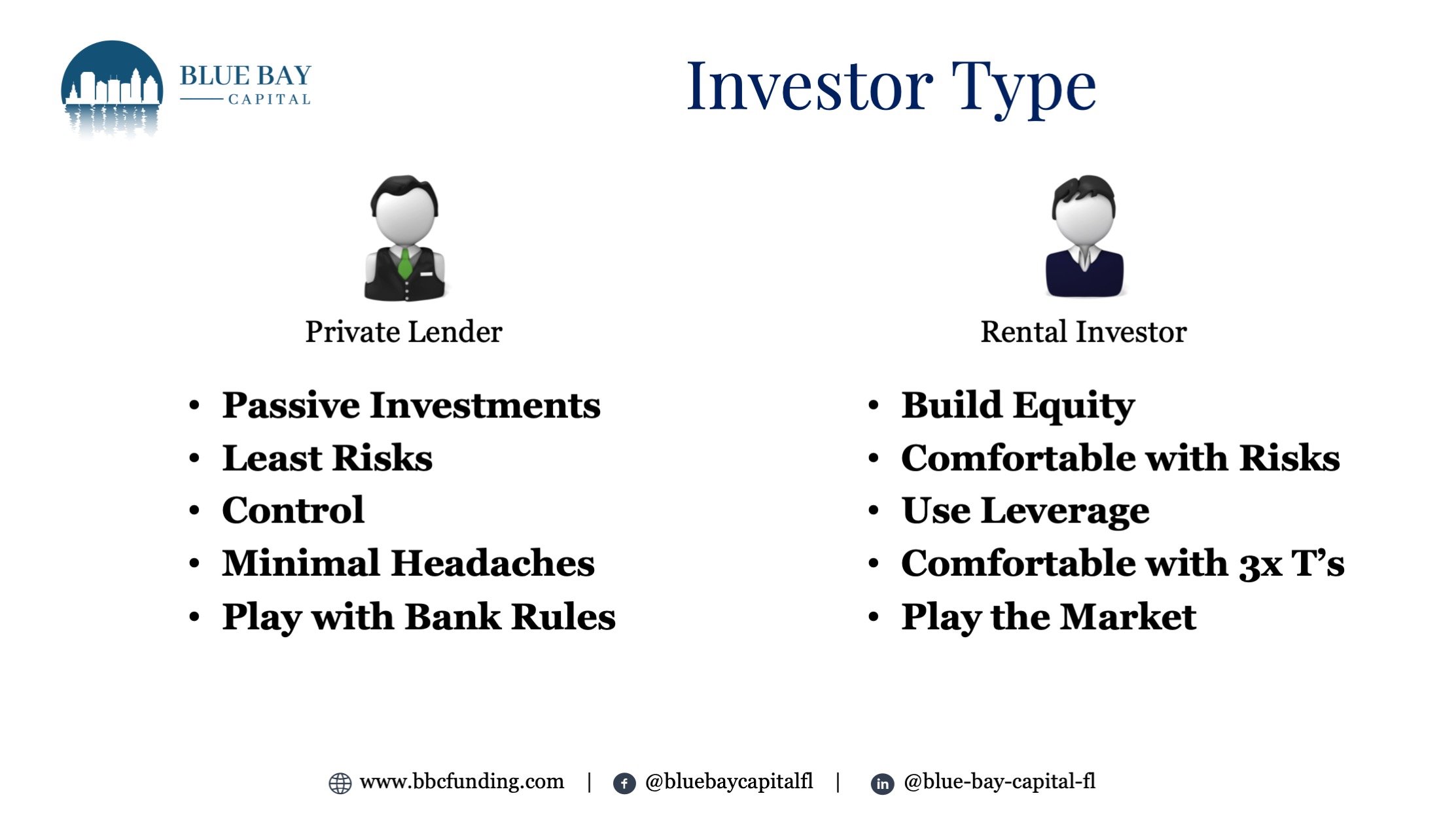

Benefits of real estate cashflow investors

In relation to cash flow-seeking real estate investors, there are two methods, private lending and rental properties. The advantages and mindset of each role will depend on who is attracted to that investment type. Strictly investing in private lending is not for everyone, and strictly investing in rental property is not for everyone. Knowing what your financial goals are and how you want to accomplish will significantly help in determining which type of real estate cash flow investor you should be at this moment in your financial journey.

Risks to real estate cashflow investors

What is rarely talked about are the risks, from a purely factual standpoint. If you ever attend a seminar on how to be a private lender, or invest in notes, and how to own rental property, you will only be trained to think of all the benefits to that one particular investment philosophy as well that philosophy is the answer to all your investing needs. I do not believe that is helpful nor true. There are advantages and disadvantages along with unique risks with each one of these investment strategies.

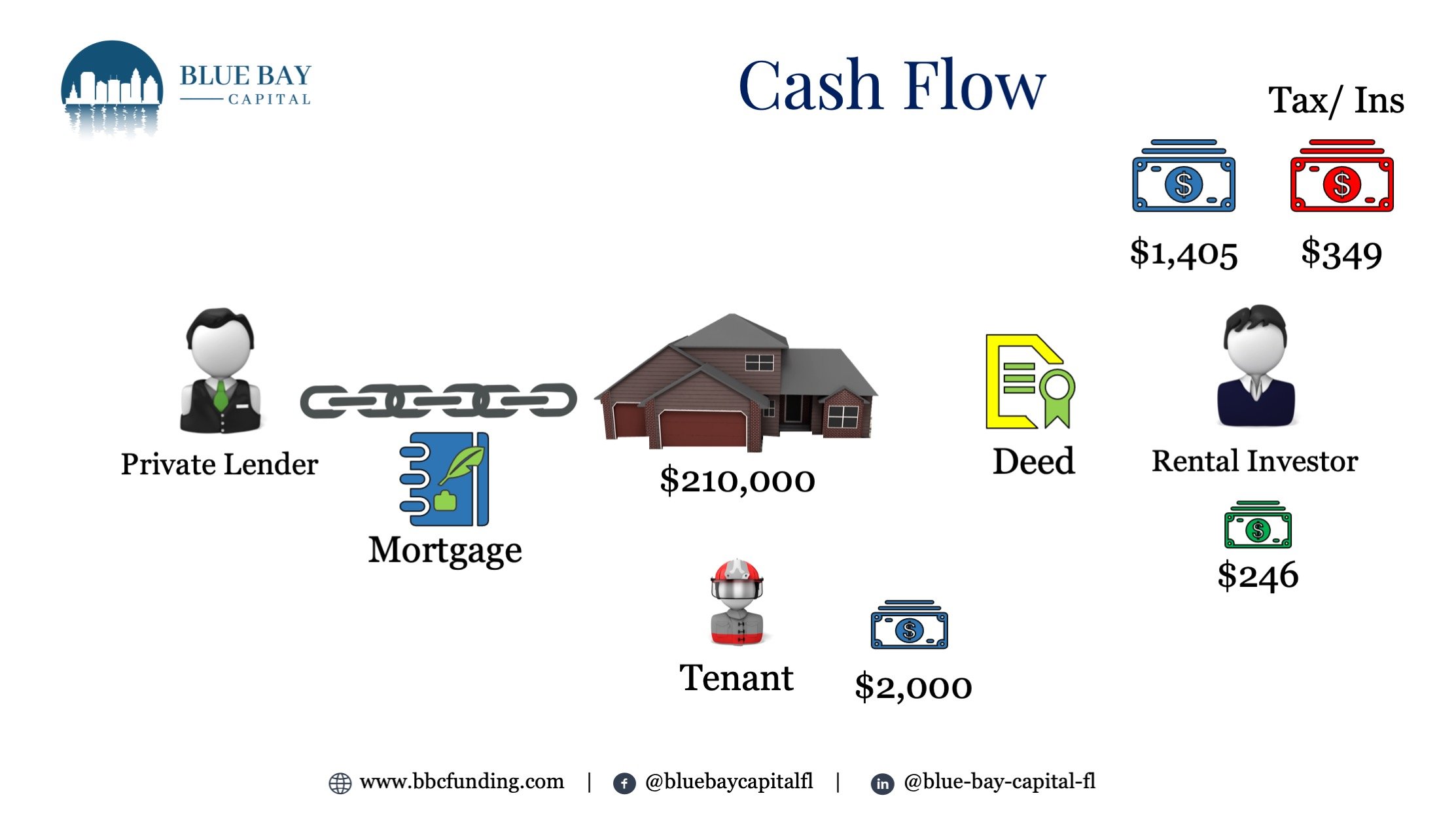

Borrower is slave to the lender

At the end of the day, this saying is true, it’s biblical. During the next couple of slides, I will go over how this saying is true, and depending on which side you play on, you will benefit from. In this first slide, we have a lender with $150K and a borrower with $150K. The borrower wants to use leverage, ie the lender’s capital to help him buy this property. The As-Is value is $210K, so the borrower does not have enough, but he does have 30% to put down towards the loan. The lender is willing to give a $147K loan @8% annually, amortized over 15 yrs. The PI payment is $1,405 per month, the borrower will have to pay for taxes and insurance themself. The borrower has to put down $63K but still has $87K remaining.

True costs to owning rental property

What is rarely discussed though are the ongoing costs of rental property ownership. Unlike note investing, there are little to no ongoing costs, less the servicing cost of your loan, only if you hire a servicing company to handle that. On the rental property side though the borrower must make their payments for taxes and insurance. We are not counting repairs, owner-paid utilities, and maintenance costs that must be set aside to cover those emergencies. If the borrower has a tenant that is paying $2000 a month then after his payment to the lender and setting aside for taxes and insurance the borrower is left with a positive cashflow of $246 per month.

Return on investment for cashflow

Lets look at the real costs as well a more realistic ROI. On an annual basis the private lender has made $11,569, which works out to be 7.87%. The reason its not a true 8% is because the principal is being paid off so the earned interest each month slowly decreases because the previous month there was not that much principal. In an interest only loan this would not happen, yet the principal also would remain the same. The borrower only earned 4.68% on their initial investment. If there was an emergency or unforeseen costs this could easily eat into their annual return nullifying it or even having the borrower operate at a loss. The BIG benefit is the borrowe ris building equity and now the equity is higher 1 yr later than when the borrower started. I did assume an appreciation based on historic national averages which measure at around 4%, though it could vary greatly based on the location of the asset.

Make it stand out

What are the tax advantages to rental property ownership and private note investing? Well honestly, this is where rental property ownership shines. Owning rental property definitely provides more tax advantages, private lending … not so much. The one unchanging play in either role is the type of account where the investment comes from. If the invest (note or rental) uses a tax-advantaged account, such as a SDIRA or Solo 401K with a ROTH component, then the income generated from the cashflow could grow tax-free. Thats a discussion for a different day though. At the end of the day, consult with your CPA or Tax advisor to find the best way to invest yet reduce your tax liability.

FREE EBOOK! Download it below to discover a side-by-side comparison of investing in dividend-paying stock, real estate rentals, and private loans.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do by lending your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution. You can learn more about my Turn-Key solution by clicking on the bottom below.