GAP Funding

BLUE BAY CAPITAL DOES NOT PROVIDE GAP FUNDING!! WE STRONGLY ADVISE PRIVATE LENDERS NOT TO MAKE GAP LOANS! ALL REQUESTS FOR GAP FUNDING WILL BE REJECTED

Hello investors and good day. I trust your week has been incredible and you are being productive and profitable. In this video, I wanted to discuss a very hot topic and a very dangerous loan option I see being presented by many real estate investors to new private lenders. The term GAP Funding is often associated with high returns, quick turnaround, and fast profits for the lender. The issue is that most new lenders are not aware of what exactly GAP Funding is, and if they are speaking with their borrowers to educate them, then they are allowing the fox into the hen house and taking the fox’s advice on how to secure the hen house against… foxes. In this video I advocate against newer private lenders participating in this type of loan, as well I offer some measures that they can take to shore up their risk and shift more of it to the borrower.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

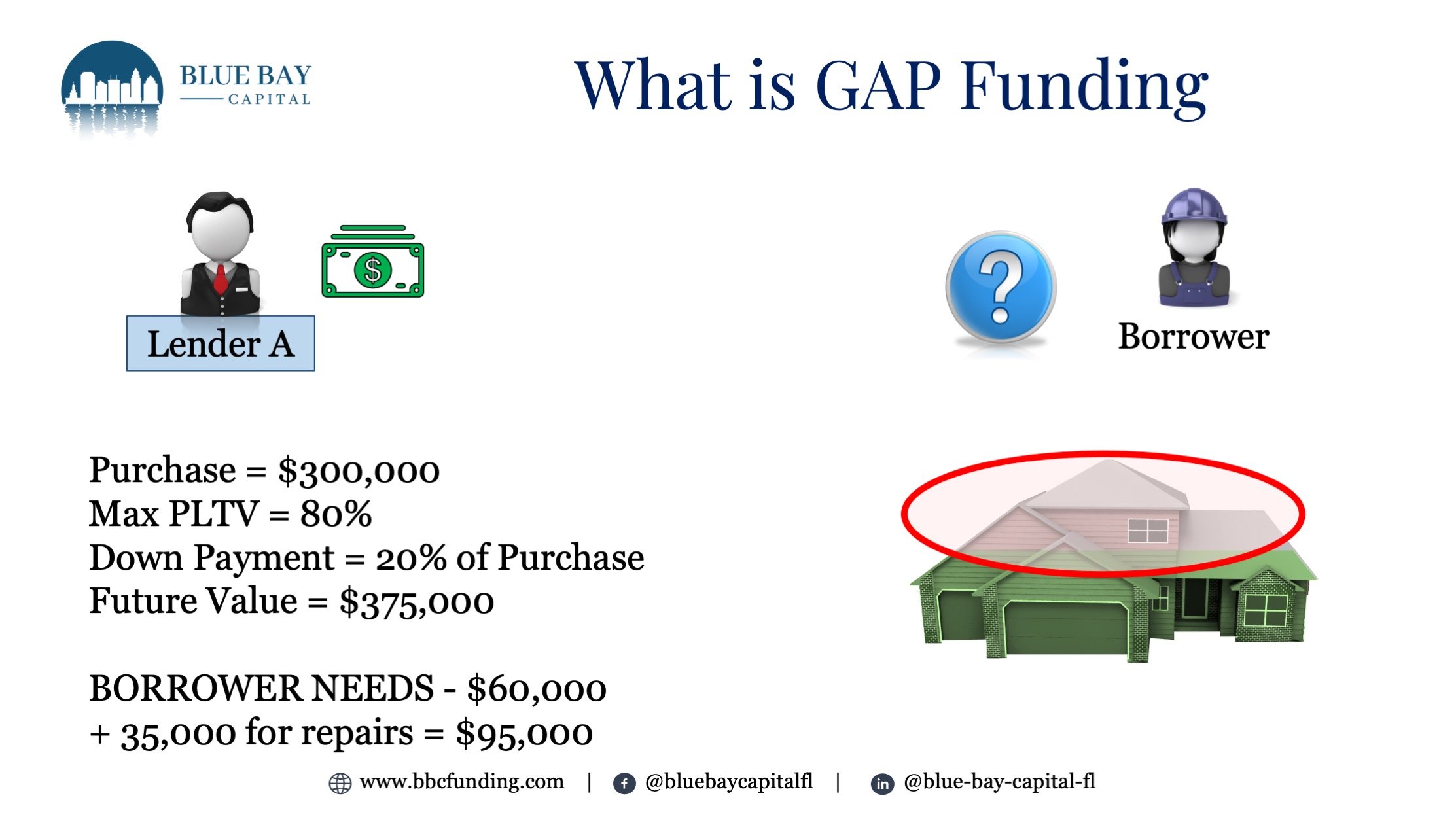

What is GAP Funding?

We have a scenario. The borrower has a property that they will be buying, and they need a loan. So they find Lender A who has the funds to loan but they have some restrictions. The Purchase is $300K. The Lenders maximum Purchase loan-to-Value is 80%. This means the Borrower must bring 20% of the purchase price or $60K. The future value once fixed up will be $375K. The amount of renovation is only $35K and is basically cosmetic, so the expected time frame for the borrower is only 2-3 months. The problem? the borrower does not have the 20% nor the repair costs. What will they do?

Are GAP loans secured?

I am obviously comparing a recorded 1st position loan with a GAP loan. While there are several significant variables here I’d like to point out the obvious. As a GAP lender, you will never be in 1st. The only way you would be in first is if the property were paid for in cash or refinanced, but that’s not a GAP loan it’s a 1st position loan. Whether a GAP loan is secured or not or has a lender’s title policy actually depends on the private lender requiring these. Just know that in 99% of all deals, if the borrower’s Lender A is aware they are getting a loan for the downpayment and closing costs they will not make the loan, so you would have to be unsecured.

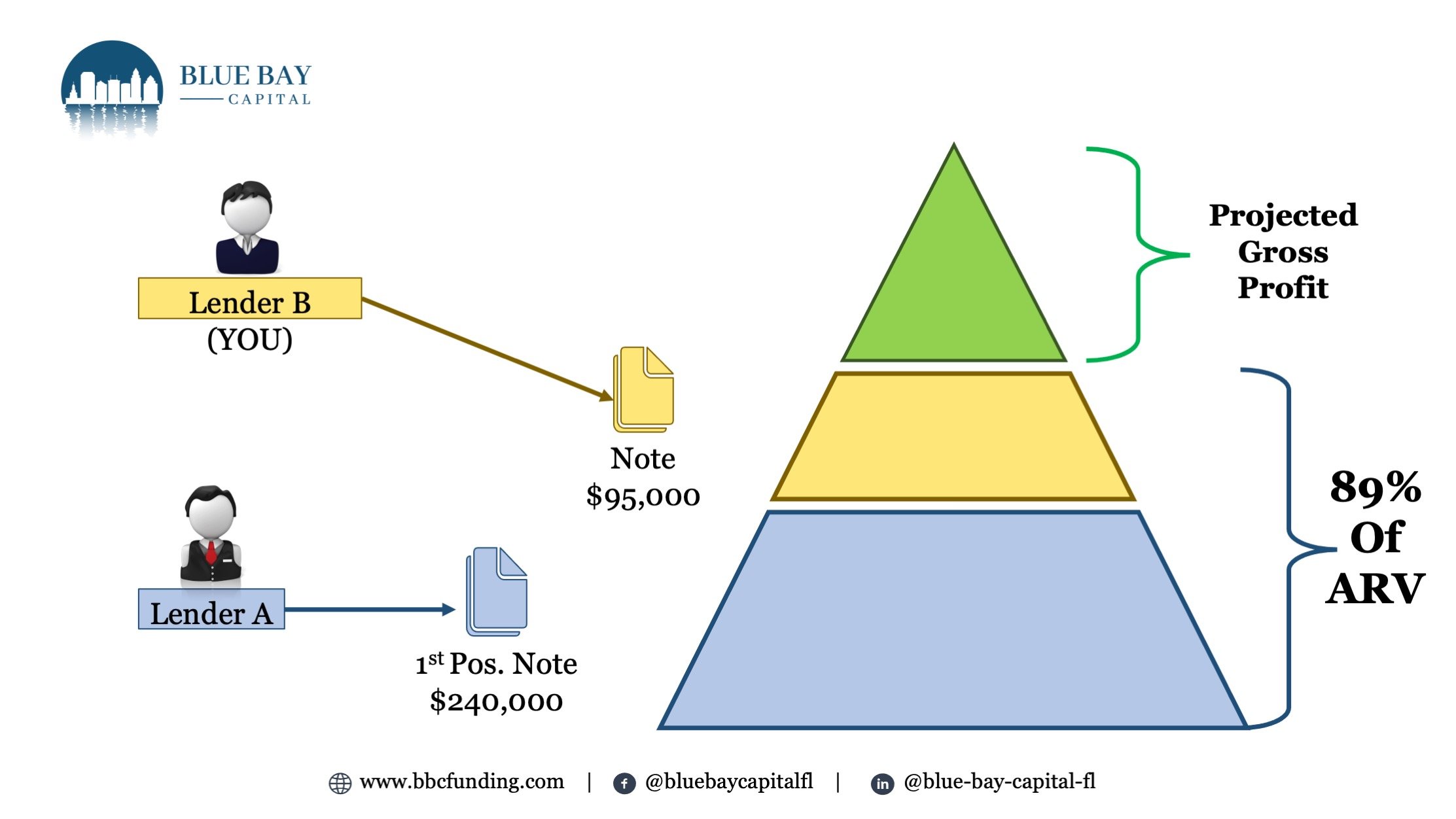

The Capital Stack and why it matters

Let’s assume though that your loan is secured, and secured in 2nd position. What we have here is commonly referred to as the “Capital Stack” or the debt and equity structure of a deal. The 1st position lender is always the safest, assuming correct underwriting. Even though you have a 2nd position loan, it’s considered as ‘equity’ in the capital stack. Why? Because it is unsecured and the performance of this loan is dependent upon the exit of the 1st position lender. You also would have no recourse against the borrower if your GAP loan was unsecured.

Position, Position, Position

You may be getting tired of hearing me say the 1st position lender, but I cannot stress this enough. For seasoned and experienced lenders then this is something that you could consider, but only because you have the experience, knowledge, and know-how to mitigate your risks. New private lenders do not have this. It is always my strong recommendation not to participate in GAP loans until you have plenty of experience and you are completely aware of and ok with the risks.

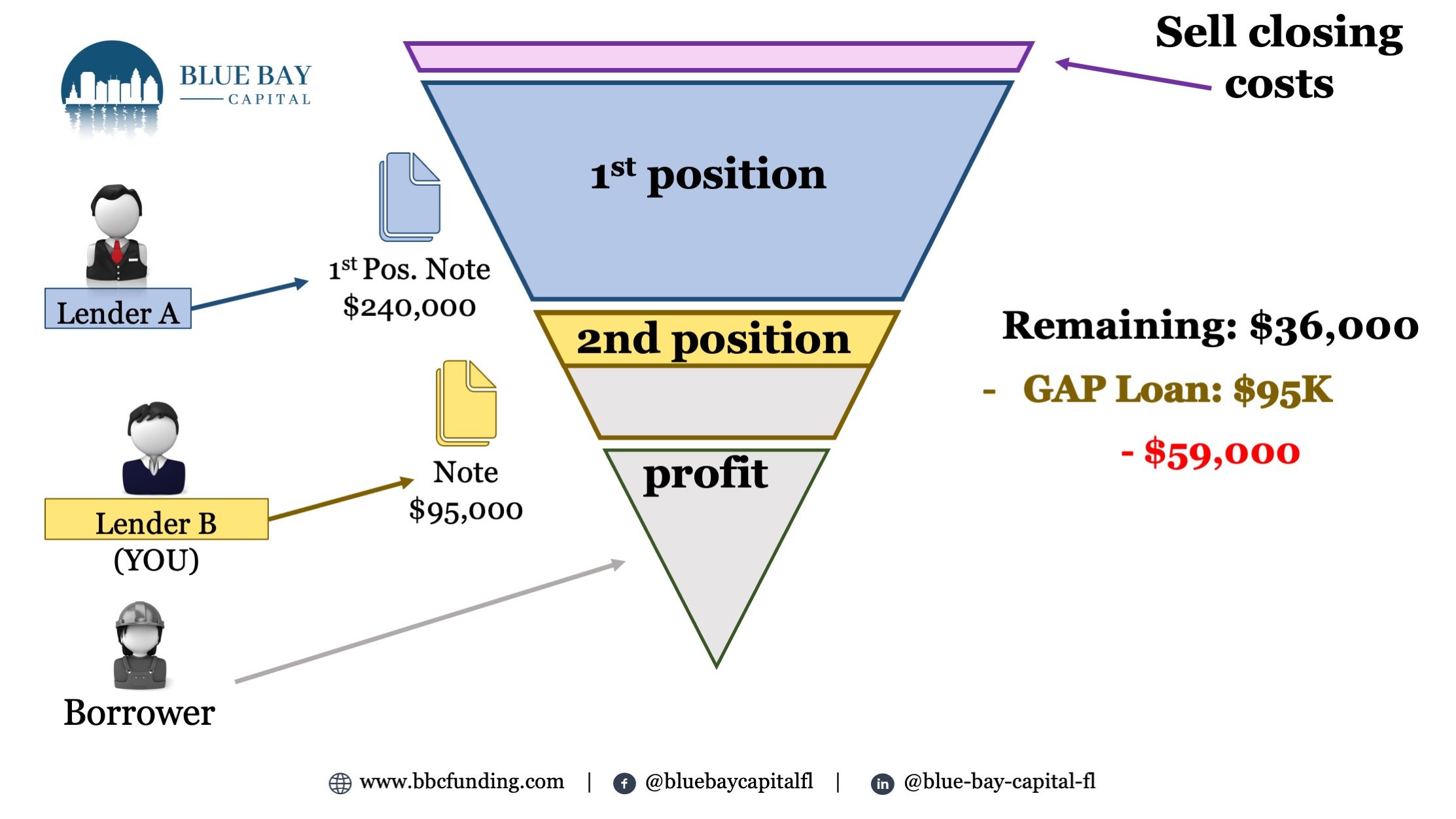

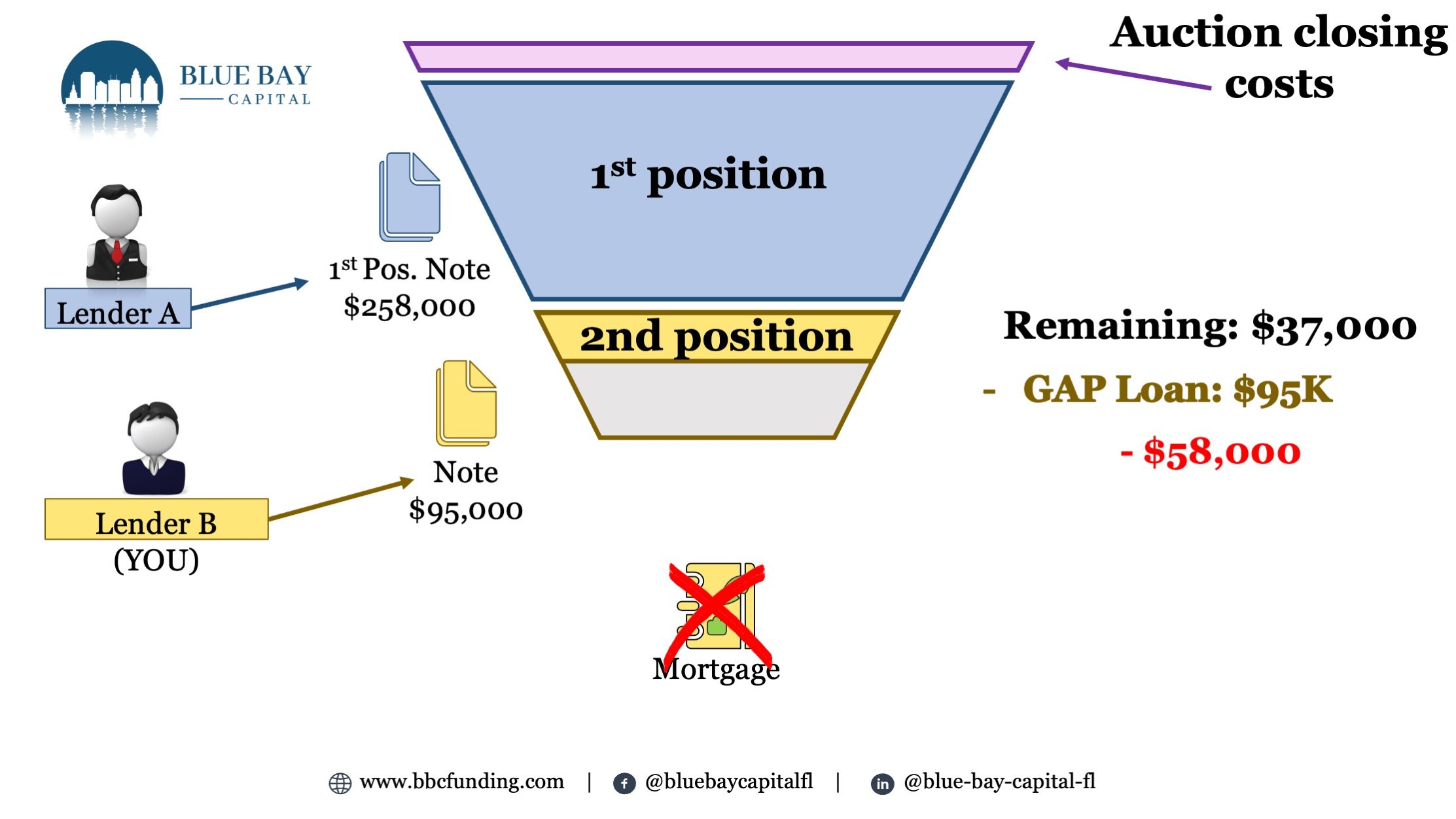

Foreclosure overview and GAP risks exposed

In the case of a foreclosure what happens? You will most definitely want to watch the video as there are several slides missing from this overview that provide a great in-depth look at the foreclosure process and how this affects a GAP loan. Just know this, whether you are secured or not, the results could be detrimental if the project ever goes wrong. And let me tell you from experience, someone who is requesting GAP funding, is typically not experienced, or they do not have the capital to handle the deal to begin with… what happens if the deal goes South?

It boils down to security, are you secured?

No matter the result, if a loan were to go South, and you had a GAP loan on the project, the likelihood that you will get wiped out is pretty high, with a best-case scenario of you collecting 100% of your capital almost non-existant. Be aware of what type of loans you're investing in, making and always look for ways to shift risks to the borrower and away from you. By virtue of what a GAP loan is, you as the “lender”, are assuming ALL the risk of this type of loan structure, while your borrower assumes no risks, but enjoys the reward. If all goes well then this works out, but if things don’t go well, the likelihood the borrower simply walks from the project is very high. Choose wisely.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do, and lend your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution.