What are Private Notes

In this video, I discuss the primary types of notes. This is not conclusive and there are many niches in note investing. My goal is not to compare all kinds of note investing, but to compare the two primary types. That would be secured note investing, and unsecured note investing. In this video, I go over the differences between the two, and why investing in notes secured to hard tangible assets is the safest and most risk-mitigated way to invest in notes. I also go over why investing in notes secured to real estate is the absolute safest way to invest in notes.

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

What is a note?

The definition of a note is quite simple. A note is a physical representation of your capital (the lenders) given to you by the borrower. The note tells all parties involved how much you are lending, what is the rate of return, when you should expect that note to be repaid, and the payment structure of the note. This is just like REAL money because its a legally binding document, enforceable in court that is a representation of the exact amount of money you loaned. Keep it secret, keep it safe.

Secured or unsecured thats the question.

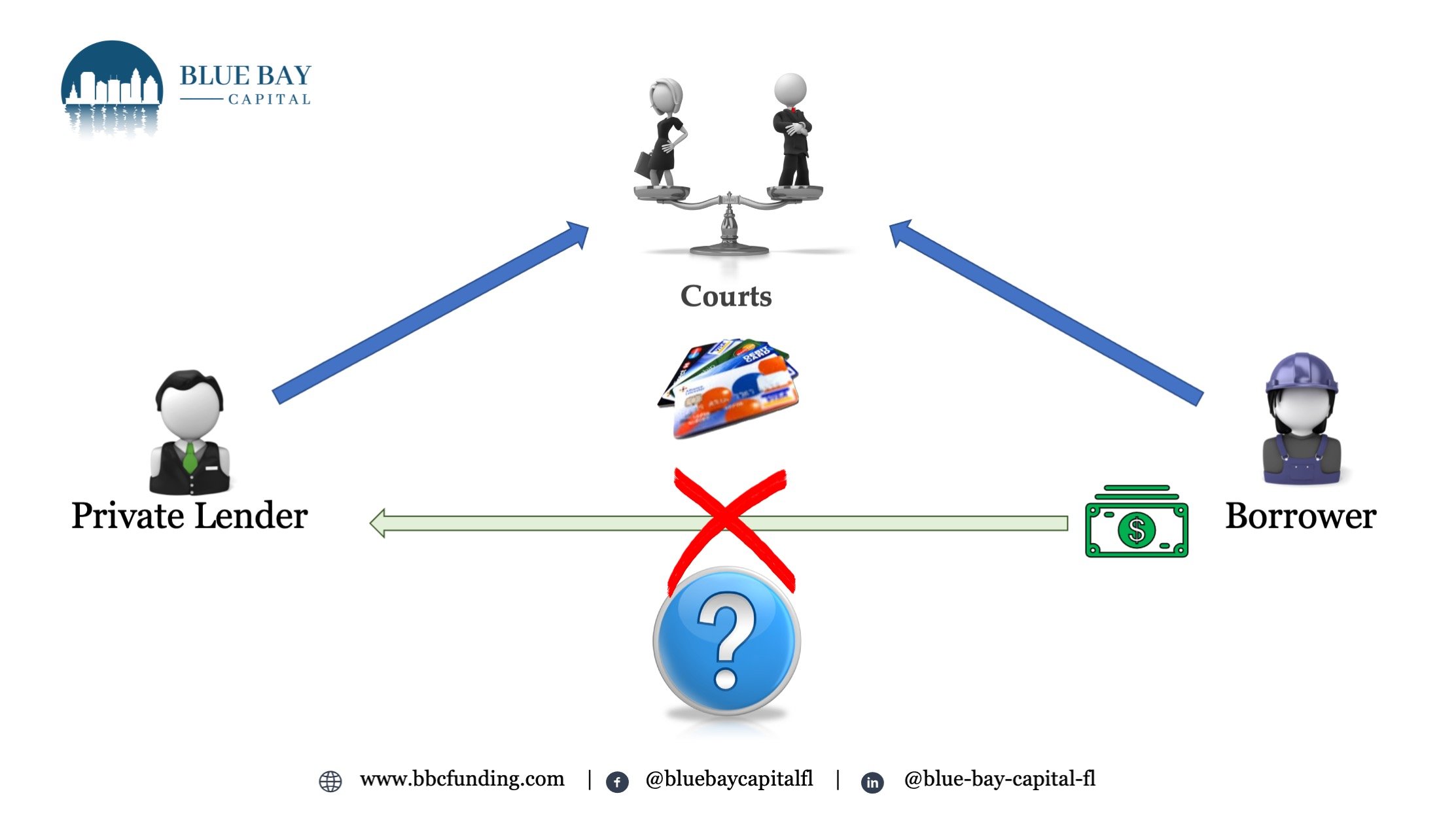

When an investor makes a loan, and they receive a note from the borrower, they may think that that note alone is all that is needed to “secure” their capital. I mean, the borrower did personally sign for the loan right? However, we need to understand that there are more nuances to lending than simply getting a piece of paper signed by the borrower. The greatest tragedy in lending is when a lender thinks that their loan is secured and in reality it is not.

Whats the worst that could happen?

The worst that could happen is the borrower doesn’t pay correct? Well in the case of an “unsecured” loan that worse case can be much… worse. Primarily because if the loan is unsecured (think as if you just gave the money to the borrower and they went to Vegas to spend the money) then you must take the borrower to civil court. You will spend time and an obscene amount of money on attorneys and its likely you will never see your principal balance again.

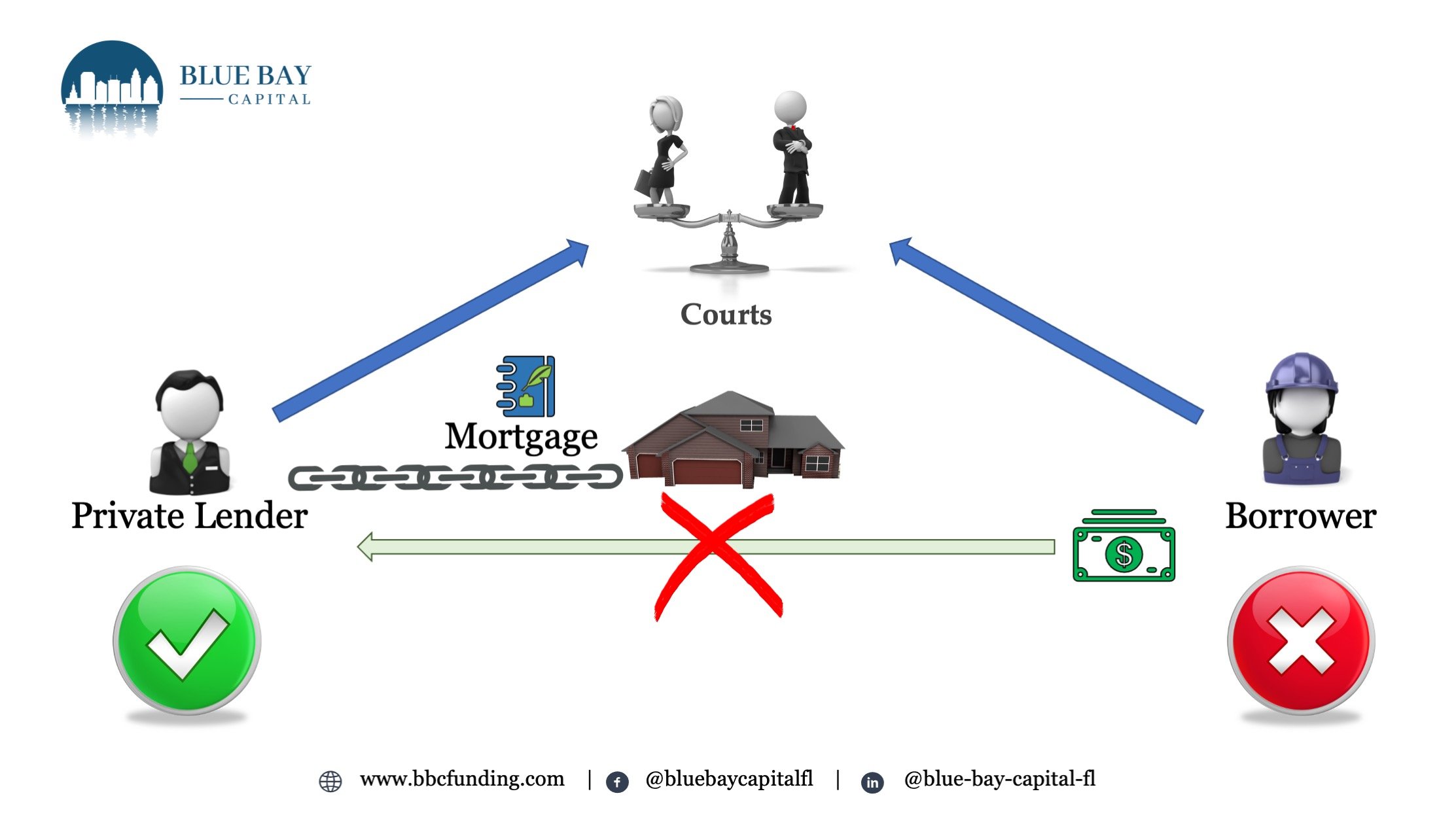

Security helps you sleep at night.

When your note is properly secured, via a Mortgage or Deed of Trust (I discuss the differences in another video) you have the courts in your favor and have basically backed your borrower into a corner. They can fight it in court, and you both will rack up litigation fees, however your properly secured note via the mortgage, is what guarantees that you will own the property should you foreclose! If you have underwritten your file properly (meaning mitigated and shifted all risks) then you ar in a great position.

Decision point active or passive investor?

So really the question for you is do you want to be a passive note investor or an active note investor? Being an active note investor takes time, knowledge and experience. This also will put demands on you equivalent to another career. This is not for the part-time, or faint of heart. Passive note investors however gain all the benefits of note investing without the requirements to build a business. Which one would you rather participate in?

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do by lending your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution. You can learn more about my Turn-Key solution by clicking on the bottom below.