5W’s of Private Lending and How

Hello Capital Investor! I trust your week has been productive and profitable. I want to share with you the 5 W’s of Lending and the How. This is by no means a full educational video. I would need to create a 30-hour course just to cover the basics… actually that’s a good idea! I may have to do that. (*hint - I am actually working on this and if you’re interested, shoot em an email and I’ll get you a seat on the next Private Lending 101 course). In this video I cover the high-level ideas about Who, What, When, Where, Why, and How private lending should be a part of every investor’s portfolio, and how my turn-key private lending solution can solve this hurdle for you. Watch the video above and let me know what you think!

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and shoot me an email, or discover more about my Turn-Key Private Lending Solution!

Where do the wealthy invest?

We see it in every town, city and country, real estate. Some investors build their wealth only on real estate, and others use real estate to preserve their wealth. However, you decide to approach your wealth building and preservation at the end of the day it comes down to protecting your wealth. I believe that lending offers the premier investment vehicle to do so.

Who can invest in private notes?

The question of WHO can invest in private loans has long eluded many qualified investors. Most people think you must come from wealth or have extremely deep pockets. Traditionally speaking this is true. I mean, if the average loan is $250 - $300K and you have a million to invest that’s only 3 to 4 “assets” (assets being the promissory note secured to the real estate). But this is not necessarily true, and I explain why in the video.

How to invest like a banker does

To invest in private notes secured to real estate (ie private loans) every potential investor must change their mindset in how they would like to go about doing this. Primarily they must have a paradigm shift… to that of a “bank”. The way that banks make loans, offers many educational points but these three are the ideas, and approaches that any investor can use to build, protect and preserve their family’s generational wealth.

When is the right time to invest in notes?

The market and economy are always hot topics for real estate investors. Is the market going up or down? Some investors are not sure if investing early in their career or later in their career is the best time. For others, it’s a matter of private lending for growth-focused investors or cash-flow-focused investors. No matter WHEN you find yourself interested in investing in private loans, I believe that Blue Bay Capital’s Turn-Key Private Lending solution can provide you with answers as well as confidence in becoming a capital partner.

Where should I invest in private notes?

This may actually be one of the more confusing and concerning obstacles for newer private lenders and note investors. I discuss why no matter where you are wanting to park your capital in private loans, it can make sense for you.

Your why will fuel your how

As Simon Senik has made famous, knowing your WHY is the MOST important topic for anything you are pursuing. I discuss some of the most important aspects of private lending and note investing and why, adding note investing through Blue Bay Capital’s Turn-Key Private Lending solution, will make perfect “cents” for you and your investment strategy.

Reduce risk in your investments

All investments have risks, and private lending is not insulated from risks. However, we have a powerful tool that no other investment strategy allows and that’s risk mitigation. The ability to cover your downside, and shift all remaining risks to the borrower. The ability for you to MAKE your investments as safe as possible cannot be found in any other investment method. I discuss what private lending is so powerful and how my Turn-Key Private Lending Solution can facilitate your note investing strategy.

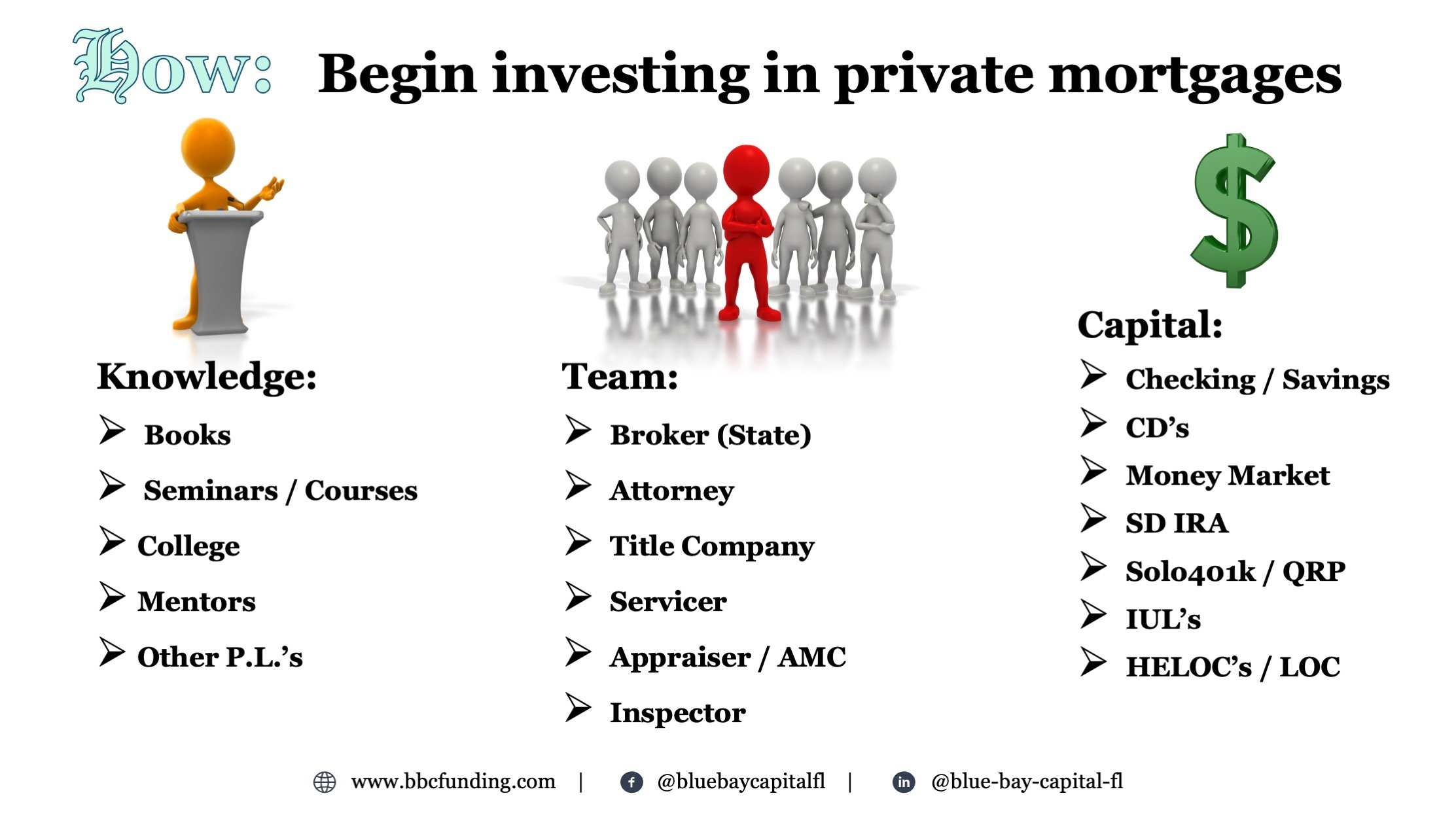

Private lending education

I have heard it said that the how will come you need to make it “attractive” for people to want to learn. Yet I have found time and time again that at the end of the day, investors who truly want to diversify and invest in alternative investments want to know HOW they can do this. While the video briefly covers the how an investor can become a private lender I am working on a 30-hour course that will actually teach any capital investor how to make private loans, secured to real estate. If you are interested din this course please shoot me an email and I’ll be sure to add you to my initial release class when it launches.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do, and lend your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution.