How to make sure my loan closes on time

What information will my lender need?

Every lender is different, and even more so when comparing a lender for your personal residence versus an investment property. Then of course, there are many different property types (each requiring a different set of documents), loan purposes (each requiring a different set of documents), and project types that an investor would be looking for funding on. This is NOT an all-encompassing blog about every type of loan file, loan purpose, and loan borrower. What I will focus on is the most common borrower type, property type and project type that I fund through Blue Bay Capital. So let’s break down the documents and information that you need to have readily available to submit, whether through Blue Bay Capital, or any other lender you choose to work with. At the end of the day having these documents readily available, complete and legible will shave literally days if not weeks from your timeline to close. Imagine knowing that you could confidently tell your seller that you can close in 10 days or less and KNOW that you can perform!? It’s an amazing thing to have that confidence when negotiating a close time, even more so when you know you have a lender that can perform just as quickly.

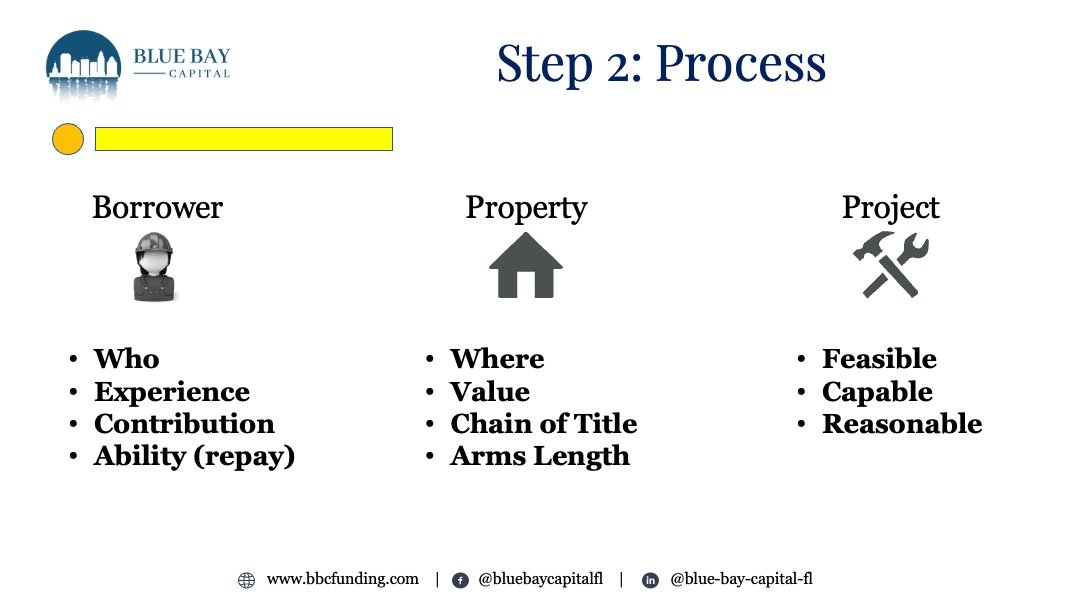

What information is needed from each of these categories will be detailed below, but first we must cover WHY a lender is going to ask for these documents/ information and why you should have these available for any lender you submit your loan request through. This slide is from a previous educational video I made for capital investors wanting to become private lenders, so what better way for a real estate investor to know what documents are needed by a private lender than reviewing the very information that private lenders are looking at right? In this section slide you can see some of the questions that a private lender needs to have answered by the documents they are gathering from you the borrower, or from the document’s they receive by ordering them (ie; survey, appraisal, feasibility study etc..). Now that you have an idea of WHY the lender is needing to view these documents and what primary questions they are asking when reviewing your documents, let’s dive into the most common, and most widely accepted documents for each one of these categories by lenders.

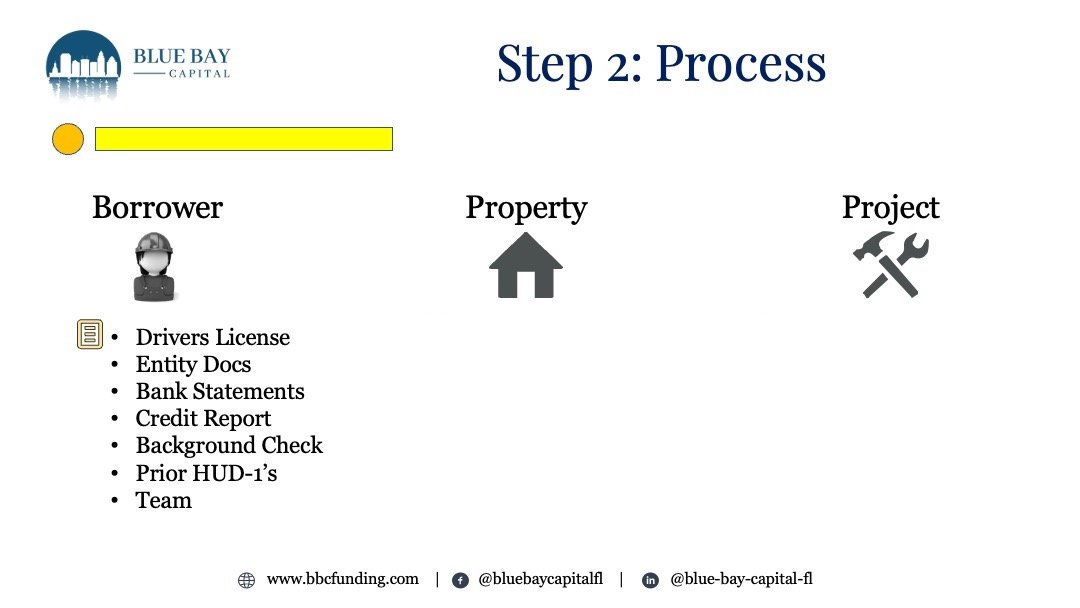

Borrower Information

So these are the most common documents that you will need for you personally. These include a driver’s license, your entity documentation, prior HUD-1’s / CS of properties you have purchased and sold, and information on the team you have surrounded yourself with to help you complete your project. Hint- The address on your driver’s license should match your current residential address, where you reside. If not the lender may ask for resident confirmation such as a utility bill, or lease agreement/ mortgage any of which should have your actual residence on file. This is the address you should use for yourself personally in your loan app. Also know that while having a PMB or PO Box is sufficient for the state of your business address, it will not suffice for where you personally live. Be aware that your lender may require proof of residence if you initially supply them with a PMB or PO Box. A good rule of thumb is to keep your driver’s license up to date with your current residence. This will prevent confusion and delays from our lender, trying to figure out exactly where to contact you. Privacy and difficulty in locating you may be a goal for other creditors, but when it comes to your real estate investment lender this will only cause delays and frustration on your part. Be upfront and honest with any and all personal information when submitting your loan request.

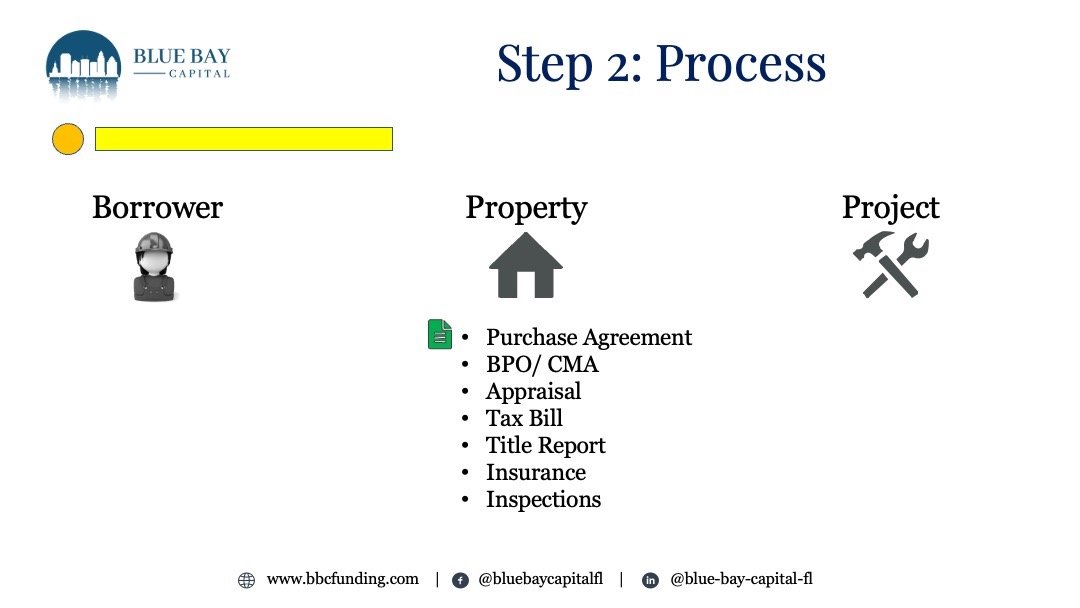

Property Information

The next section we will cover is the property details. These documents may very vastly depending on the type of property and even the purpose of the loan (think construction loan versus a 30yr rental loan). In general, you should have available the Purchase & Sale Agreement if purchasing or the Warranty Deed if you are refinancing. A CMA or BPO will help the lender know that you are confident of your property values, but they are not necessary. Appraisals your lender will order and you will pay for, so DO NOT get an appraisal prior to submitting a loan request from your lender. Many lenders will not consider appraisals paid for by you or even ordered by other lenders. The tax bill, more important on a refinance, and of course property insurance, current or quotes depending on whether its a purchase or refi. Inspections may be required by a lender funding construction or if the property is an older property being refinanced. At a min. having inspections completed, only help you, the investor, and your lender you are taking all risks into account before embarking on your project. Last but not least is the title report, but the lender will order this from title, BUT you can help expedite this process by ordering a title search from your title company and speeding up this process for your lender.

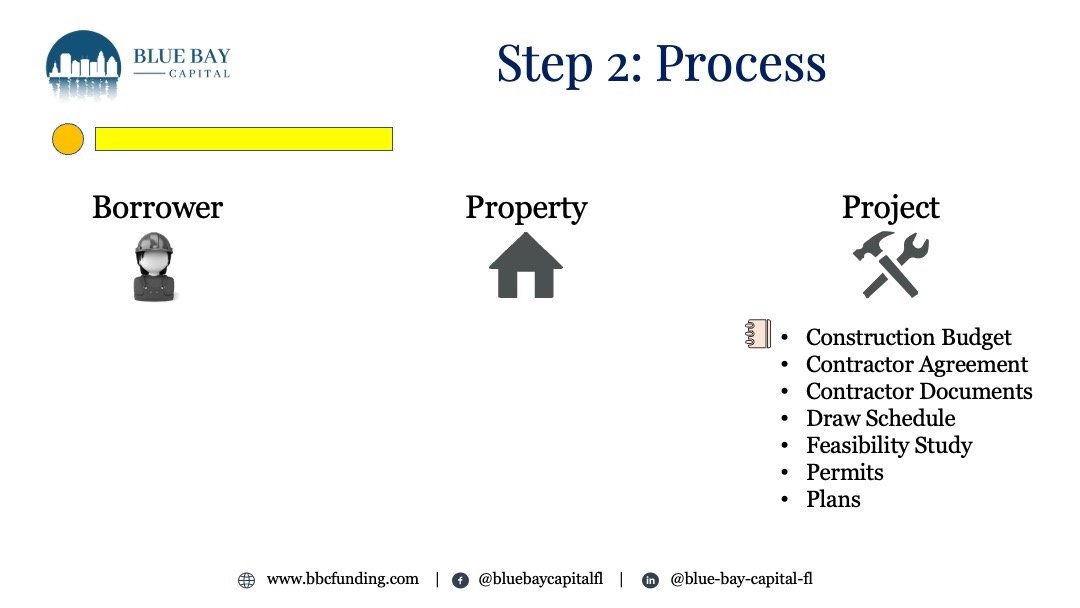

Project Information

Ahhhh, the project. While this section is really focused on renovation investors or new construction, there are a different set of documents needed for a 30yr or “long-term” rental loan that a lender will need to see from you. For now, let’s focus on the renovation or new construction as these are the most common loans requested from Blue Bay Capital by our investors. The construction budget is a line item breakdown of ALL work being performed on the project, and this should be detailed by the contractor and yourself. The contractor agreement is also called the “Scope of Work” or the SOW. The SOW is basically like a story of what the contractor(s) will do to the project. This will have general overviews of the work to be completed but will also have a final bid price and should be signed by both the contractor and the real estate investor. These two previously mentioned documents are often forgotten by many investor’s and tend to take the most time to get completed versions. These documents are critical to the appraisal and to the feasibility study. Speaking of which the feasibility study is very important and this is something that the lender will order. What this report will do is tell the lender whether your proposed project can be completed on the budget proposed (hence why the line item budget is needed before ordering this, as well the study will let the lender know if after the work is complete will the property meet all requirements for property insurance of a homeowner/ rental landlord. Permits and plans may or may not be available prior to the loan closing but may be required by the lender before the 1st draw is disbursed. If you are requesting a refinance on a new construction project you should have these items. The draw schedule is simply a proposed plan by the real estate investor, to the lender, letting them know how much and how often they plan on requesting draws from their construction funding held in escrow.

Ideal Format & Storage of Information

While we do not care where you keep your files it is important to understand that having digital access to your documents is critical in helping expedite your loan requests and getting to close. In most cases today, gone are the days of sending in documents to the lender via email or fax. Having your documents in digital format, accessible anywhere is critical to saving you time, energy and effort. Most documents you should keep on hand as PDF’s or JPEGs. Some documents will need to be “wet signed”. If this is required by your lender, then know what they need to see is scanned copies of BLUE ink signatures. Other than that scanned black and white copies of PDFs ar perfectly fine. There is a GREAT mobile app that allows you to take a photo and then save it as a PDF directly to your cloud service of choice. We highly recommend investors download the Tiny Scanner App on Google Play or iTunes. We are not affiliated with this app, just huge fans!

Lender Platform

In this world of technology advancement, the lender with the out of date process looses. We strive to make the process of submitting a loan request, as well submitting all required documents easy to do and understand. With our required loan document portal, our investors can quickly and efficiently track what documents are needed for any and all loans they have requested with us. Color coding and immediate feedback from your processing team allow for clear and concise communication between you and your Blue Bay Capital team. With our color coding statuses, our investors are no longer left out in the cold as to whether a document is sufficient, needs correction, or even if its been received and in review. Gone are the days of our underwriting team, communicating with your broker and then your broker communicating with you. You know as soon as your broker does what documents need your immediate attention. Give Blue Bay Capital a try and experience truly efficient and effective processes to get your next deal funded!

If you would like access to a checklist that helps real estate investors know what documents they need for the most common loan types that Blue Bay Capital funds please fill in the information to the request an email be sent to you with the document for your download. By requesting the checklist you will be signing up for our monthly newsletter The BBC Dispatch if you are not already. If you are already signed up, THANK YOU! We look forward to providing you excellent customer service and a one of a kind experience.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do by lending your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution. You can learn more about my Turn-Key solution by clicking on the bottom below.

Are you a real estate investor looking for a way to work with a local Florida private lender? Are you tired of jumping through all the hoops with national hard money lenders that are more concerned about your credit and personal income than with your experience? Consider allowing BBC to fund your next real estate project!

Are you interested in seeing what Blue Bay Capital is currently offering its real estate investing clients? If you are a real estate investor looking for capital, then consider navigating to our loan programs below. You will know exactly what is needed, and what is required to borrow our capital for Fix & Flip, Bridge, Transactional Funding, and New Construction Loans.