B.R.R.R.R. Strategy - Florida DSCR Loans

If you have been in the real estate investing space for more than a day, you most likely have heard the term “BRRRR” or the Buy Renovate Rent Refinance Repeat strategy. The strategy makes sense. Find a property well below market value, add value, place a tenant at the new and improved rental rate, refinance into a long-term loan, supposedly getting all your invested capital back, and then repeat. The disconnect is typically discovered when the investor goes to get qualified for a refinance loan. Their expectations are most likely way higher and better than the terms they get from a bank or even a DSCR lender. Many times if not very often, the investor finds out that they cannot refinance ALL of their capital out, and thus their plan to go and buy a new rental property is now stunted. How does this happen, and why? In this video presentation, I explain the most common scenario and why this happens to real estate investors all over. If you are a BRRRR investor, or interested in investing using the BRRRR strategy then this is for sure a presentation you will want to watch!

I hope you enjoy the video! Below are the primary slides from the presentation, and a brief description of what is discussed in the video. If you have questions, scroll to the bottom of the page and check out our loan programs, or if you are interested in my monthly and quarterly breakdown of the FL real estate market and how investors should be positioning themselves, sign up for my BBC Dispatch at the bottom of the blog!

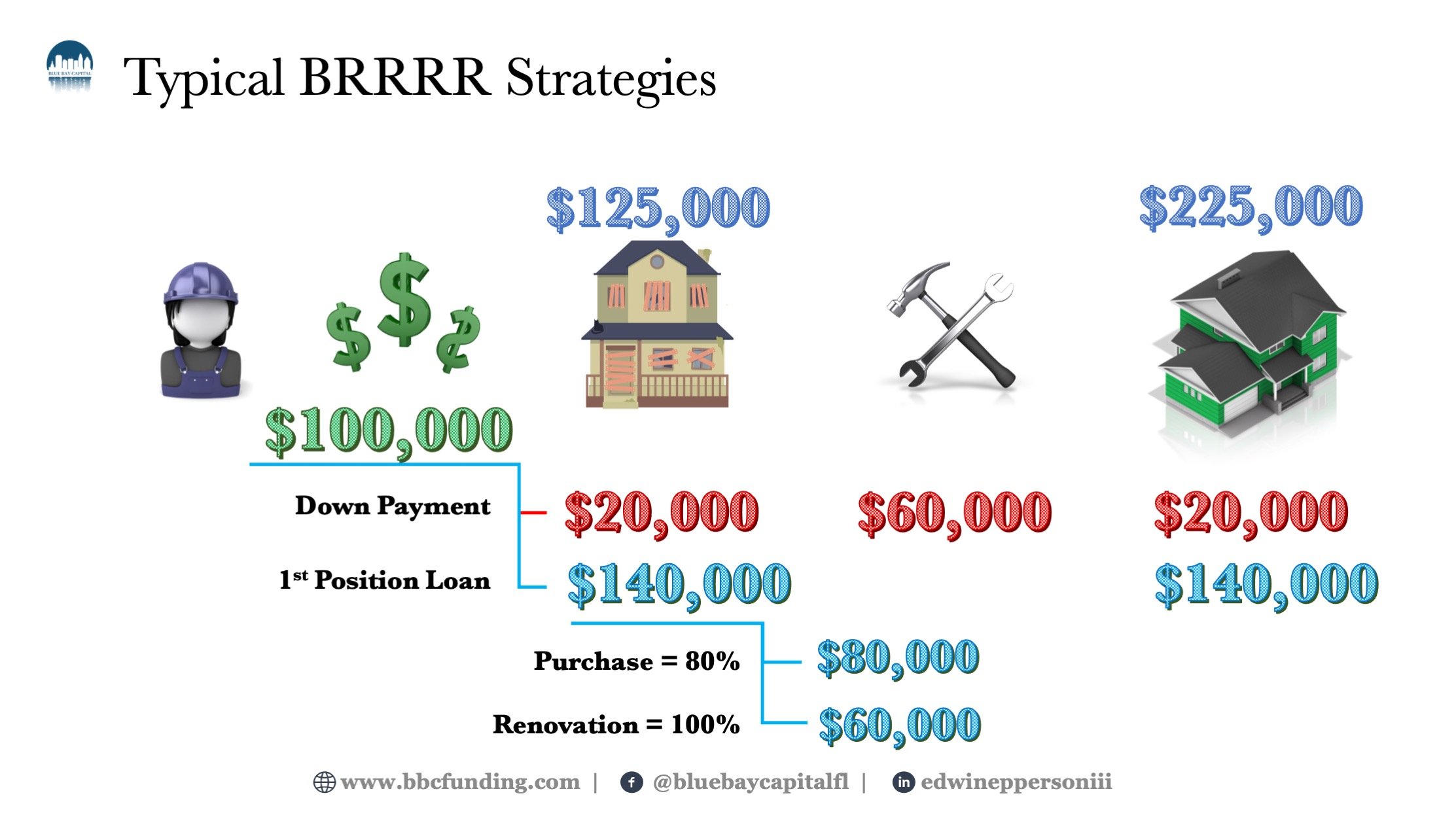

Typical BRRRR Strategy’s

In this section, I review the most common scenario when it comes to the typical BRRRR strategy from the initial purchase loan including the construction amount, and the breakdown of how the capital stack normally is seen. This is not a catch-all, and you will want to discuss your lending options with your lender as far as your initial purchase. Some lenders will fund more than 80% of your purchase others will fund less. Some lenders will fund 100% of your renovation and others will fund less. Every loan and every borrower will be different but in the investment industry, these are the most common terms so this is what I will be examining today.

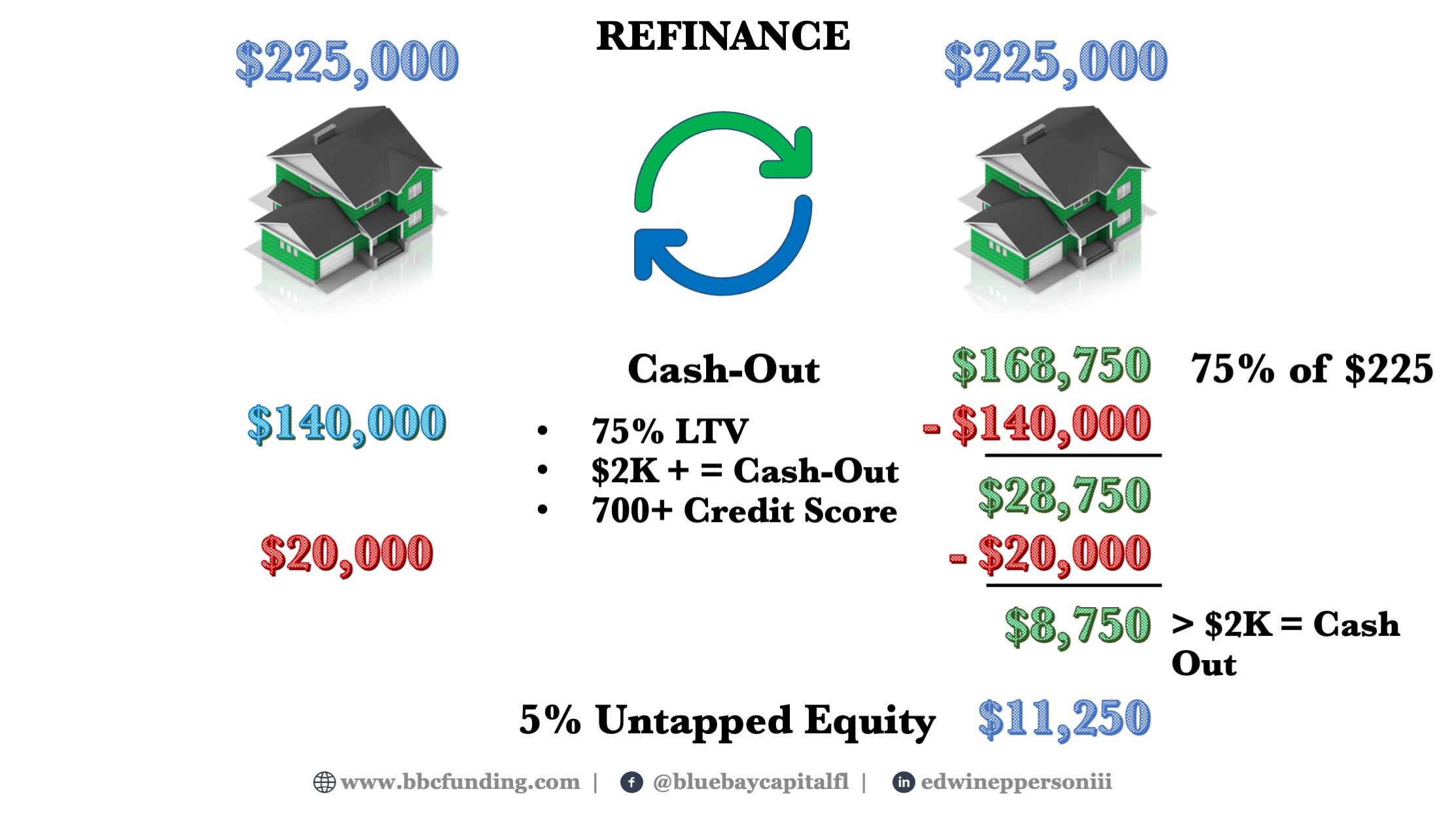

A refinance called by any other name is still a … refinance?

Before I dive into what the refinance of the typical BRRRR strategy looks like I believe it is necessary to define the two primary types of refinances. A “Refinance” is also known as a Rate & Term refinance. These two terms are often used synonymously and interchangeably. For almost 99% of all BRRRR investors, this type of refinance will not do. Remember the goal is to refinance as much as possible thus recouping your entire invested amount (basically equaling $0 into the deal). The second option is called the Cash-Out Refinance, or simply Cash-Out. This option allows investors to utilize the BRRRR method. However there is a big gaping hole as to how this actually cannot work, and I describe this in the video.

Our BRRRR Strategy solution

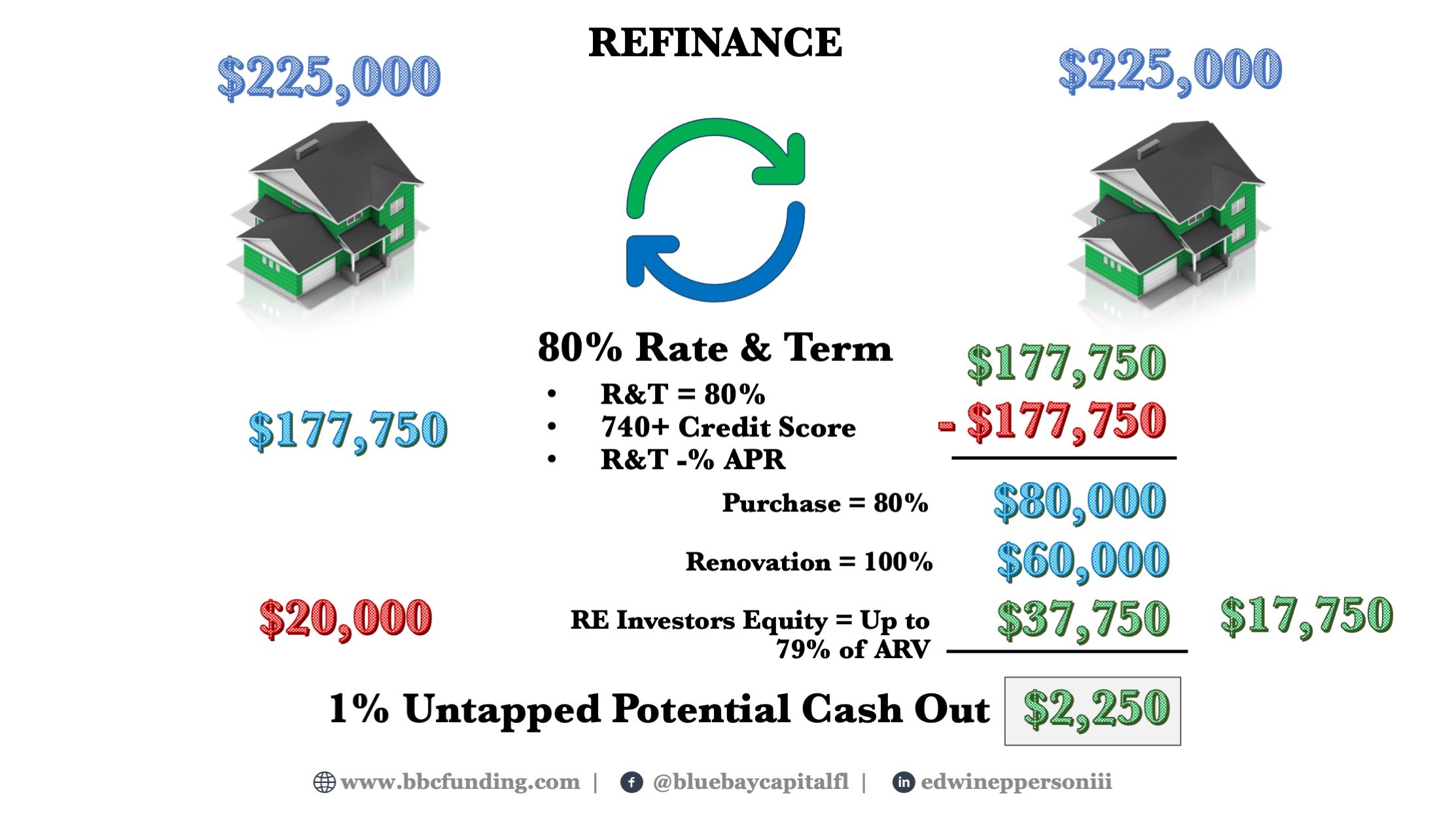

Blue Bay Capital has created a solution that is unlike anything out there today. We have figured out how to structure the loan in such a way it will be considered a Rate & Term Refinance (higher LTV and lower rate) YET the investor is still walking away with cash, and in most cases with more cash than if they went with a Cash-Out refinance in the first place! More so we have built-in protective measures so that even if you end up not qualifying for the full loan amount we can buy down your loan for you thus allowing you to qualify! It truly is a win-win solution!

Make more cash and pay less!

In this section, I dive into what the numbers look like on your Blue Bay Capital BRRRR Loan refinance, and I show you exactly how we are able to make this happen. We work closely with our investors and conduct plenty of due diligence not only on the property but also on the scope of the project so that we are confident that you will be able to refinance into a long-term, fixed-rate DSCR loan through our partner 30 yr lender. How many of the big box national rehab lenders are not only willing but able to do this for their investors? None! That’s why using a local, Florida, private lender is the best option to go with when seeking your acquisition and construction loan for your BRRRR properties!

Comparing refinance loans

One of the things I cannot stand is how "lenders use marketing to get someone in the door and then they pull the rug out from underneath them. Don’t fall for that age-old trick. In this section, I adequately and accurately compare the two most commonly used refinance loan options against Blue Bay Capital’s BRRRR Strategy loan option. It’s easy and simple. After you watch this short but informative presentation you will be convinced that BBC can help you with your next BRRRR project. Reach out and contact us to get your next deal funded right.

Are you disappointed with the performance of the markets? Are you watching your retirement accounts constantly decrease in value or not even keep up with inflation? Have you ever considered investing like the banks do by lending your money? Consider partnering with Blue Bay Capital in our Turn-Key Private Lending solution. You can learn more about my Turn-Key solution by clicking on the bottom below.

Are you a real estate investor looking for a way to work with a local Florida private lender? Are you tired of jumping through all the hoops with national hard money lenders that are more concerned about your credit and personal income than with your experience? Consider allowing BBC to fund your next real estate project!

Are you interested in seeing what Blue Bay Capital has to offer for loan programs? We keep our loan programs constantly updated and you will find the most up-to-date information available. We only lend on SFR (1-4 units)/ Condos/ Townhouses here in FL, no other states. We do NOT lend on owner-occupied properties or primary residences.